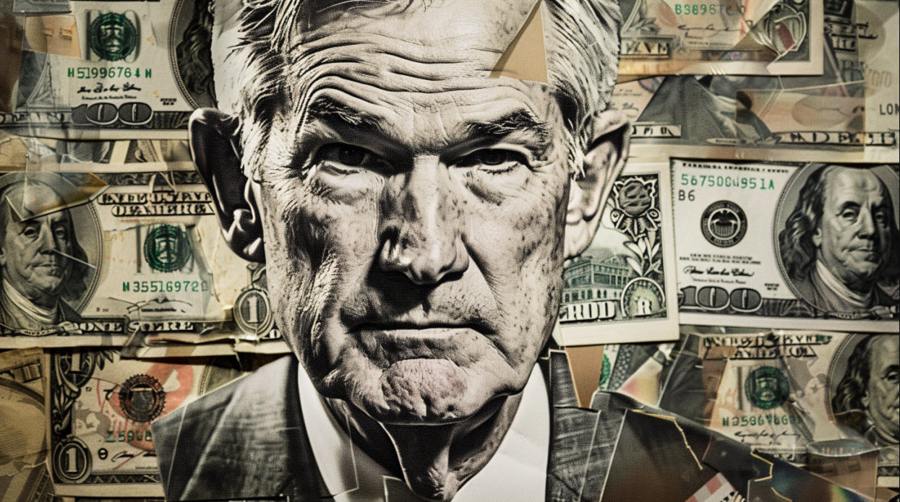

The FOMC meeting on July 31 marked the first time since ending its tightening stance that Fed Chair Powell explicitly put a rate cut on the table for the next meeting. That led to a 10 bps drop in 2s on that day.

- Vast majority said it would likely be appropriate to cut if data unfolded as expected

- Viewed incoming data as enhancing confidence that inflation headed towards 2%

- "Several observed that the recent progress on inflation and increases in the unemployment rate had provided a plausible case for reducing the target range 25 basis points at this meeting or that they could have supported such a decision."

- "Almost all participants remarked that while the incoming data regarding inflation were encouraging, additional information was needed to provide greater confidence that inflation was moving sustainably toward the Committee's 2 percent objective before it would be appropriate to lower the target range for the federal funds rate."

- "A majority of participants remarked that the risks to the employment goal had increased, and many participants noted that the risks to the inflation goal had decreased."

- "Many participants noted that reducing policy restraint too late or too little could risk unduly weakening economic activity or employment."

- Participants noted that growth in economic activity had been solid, there had been some further progress on inflation, and conditions in the labor market had eased

- Participants noted that the recent progress on disinflation was broad based across the major subcomponents of core inflation

- Price inflation in June for housing services showed a notable slowing, which participants had been anticipating for some time

- Some participants noted that the recent data corroborated reports from their business contacts that firms' pricing power was waning, as consumers appeared to be more sensitive to price increases.

There are no big surprises here but this paints a picture of the Fed on track to cut in September. On Friday, Powell should offer some hints on how much cutting is coming and how consistent rate cuts will be.

Here were the highlights of the Minutes of the prior meeting, from June.