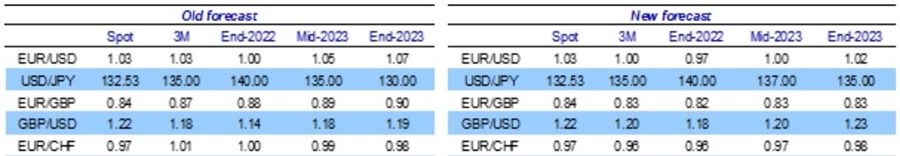

This via Nordea from late last week, updated their forecasts.

Citing, (this in brief form a longer report):

- the global economy is losing momentum

- the Fed ... are still telling us (daily for the last two weeks), that in order to get inflation back to 2% they will need to see financial conditions tighter for longer

- ECB ... is now tilted to ... err on the side of tightening too much, even if that means hiking rates on the brink or even in a recession

- Without any changes from the Bank of Japan, which we don’t expect in the foreseeable future, the door will be open for the JPY to reach 140 once more

- the Fed will deliver 50bp hikes in September and November, followed by 25bp in December

- the ECB will hike by 50bp in September and October before moderating to a 25bp rate hike in December

- the US 10-year Treasury yield will reach 4% next year, while the German 10-year yield will have to settle for 2%.