Federal Reserve Bank Dallas branch head President Lorie Logan, from the Q&A session following her earlier speech (post on that is linked below)

- achieving price stability will require labor market loosening, how much is highly uncertain

- if we find unemployment rate goes up, historically that comes with a recession, but possibly different this time

- the better data we have seen on inflation ios welcome news

- would want to see a lot more to make us confident of a shift in the inflation trend

- would also want to see easing in labor market to be confident that the trend in inflation is sustainable

- I am also focused on financial conditions

- once have stopped raising rates the risks will still be two-sided. May need to raise rates again depending on data

- balance sheet reductions are in the background and separate from the interest rate tool

- decision on balance sheer reductions won't intersect with decision on Fed policy rate

Earlier from Logan:

--

---

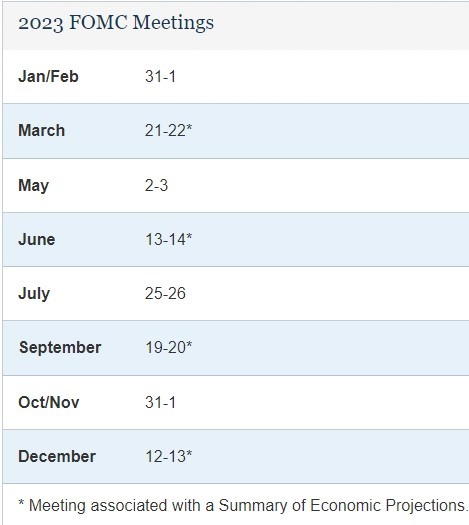

2023 Federal Open Market Committee (FOMC) meetings: