- Labor market is more-or-less back to pre-pandemic levels

- We're very much balancing our two risks and that's what we're balancing these days

- The likely direction is that we begin to loosen policy at the right moment

- The best thing we can do for housing is getting inflation down

- There was still a housing shortage before the pandemic

- Our economy has been exceptional compared to global peers

- Job creation is narrowing in the economy

- Today I'm not going to be sending any signals on the timing of future actions

- We need to see more good inflation data, that's all

- We had one really good inflation reading and one 'pretty good' one

- If we get the labor market deterioration, that could also be a case for rate cuts

- We will move carefully on rates

- We are keeping a close eye on labor market, if we see unexpected weakening there, we would respond

- We had 'kind of a bump' in inflation in Q1

- We don't need to see 2%, we need to see more of what we've seen in Q2

- "We've seen that the labor market has cooled really significantly" .. but it's still a strong employment market

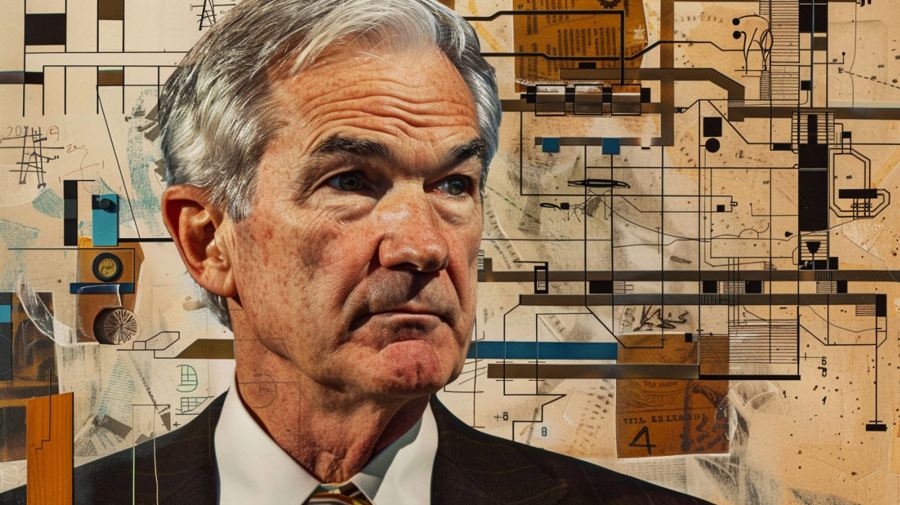

Powell said he was very careful not to indicate anything on timing and that's understandable ahead of this week's CPI report. However some in the market were positioned for a dovish shift and when that didn't materialize, a bid in USD/JPY emerged.