A snippet from RBC, responding to Thursday's accelerating core inflation in the US data.

more to come

- At 8.2% year over year the inflation rate is still very high – the highest since 1982 aside from this year – but was nearly a full percentage point below its recent peak in June.

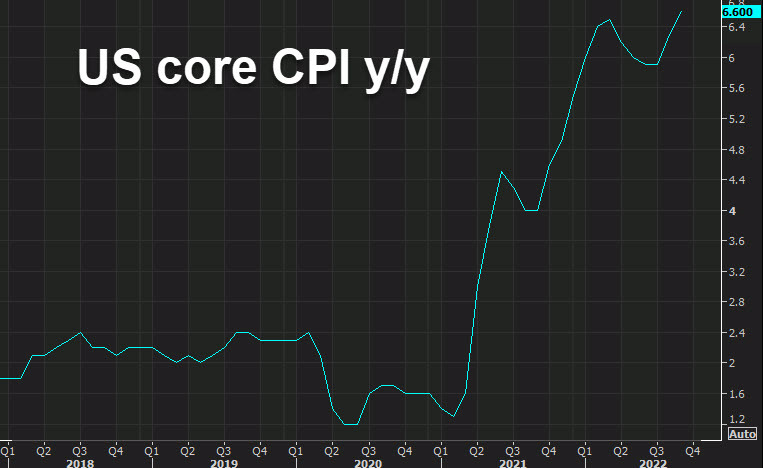

- The closely-watched “core” CPI measure, which strips out more volatile food and energy items accelerated to 6.6% year on year, or 0.6% on a one month seasonally adjusted basis from August. That’s unchanged from the pace in the prior month but was triple the ~0.2% rate in years pre-pandemic.

RBC's projection for the Federal Open Market Committee (FOMC):

- Fed’s job is not done

- still broad-based inflation pressure calls for more rate hikes

- we expect the Fed Funds rate to rise to 4.5% - 4.75% range by early 2023