The Reserve Bank of New Zealand 'shadow board' is put together by the NZIER (the New Zealand Institute of Economic Research)

- Its Monetary Policy Shadow Board is independent of the Reserve Bank of New Zealand

- the shadows do not represent what the RBNZ is going to do but rather what their view is that the RBNZ should do. That is, the Shadows do not preview what they think will happen, but what they think should happen.

The Shadow Board aims to:

- encourage informed debate on each interest rate decision

- help inform how a Board structure might operate

- explore how Board members could use probabilities to express uncertainty

In its current report, ahead of the RBNZ policy meeting this week (Wednesday, 22 February 2023 at 0100 GMT, or 8pm Tuesday, 21 February 2023 US Eastern time) the Shadow Board:

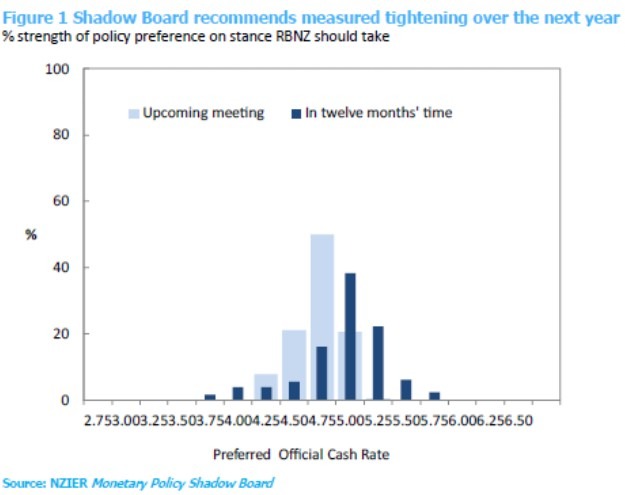

- recommend that the Reserve Bank continue increasing the Official Cash Rate (OCR)

- The broad view was a 50 basis-points increase in the OCR at the Reserve Bank’s February meeting, given inflation pressures in the New Zealand economy remain strong.

- Only one member recommended a smaller increase of 25 basis points.

- Some members also noted that while inflation and interest rates in New Zealand are approaching their peaks, the Reserve Bank should commit to controlling inflation.

----

Earlier: