Standard Chartered were forecasting a 25bp rate hike at the Reserve Bank of Australia's September and November meetings but have dropped the September rate hike forecast.

Are now expecting just one further rate hike of 25bp in November.

Stan Chart reasoning:

- We still expect a hike in November as inflation – while it may have peaked – likely remains too high. There is little margin for error, in our view, considering the RBA’s already patient stance forecasting inflation to return to the upper bound of its 2-3% target only by 2025. Services CPI remains sticky.

- The job market may have peaked but remains tight and should support wage growth. This, along with the monthly rise in home prices, may prop up spending, especially if households dip into their significant excess savings. The lack of a productivity pick-up may also increase unit labour costs, adding to inflation.

- The last RBA policy meeting statement in August slanted dovish, noting that inflation was declining (versus inflation having passed its peak in July). On growth, the central bank indicated that the economy “is experiencing a period of below-trend growth and this is expected to continue for a while”. The meeting minutes were more balanced. The central bank pointed out that the cost of inflation being higher than expected was greater than the cost of inflation being lower than expected, even as risks to inflation were balanced. The RBA also retained the option to hike further.

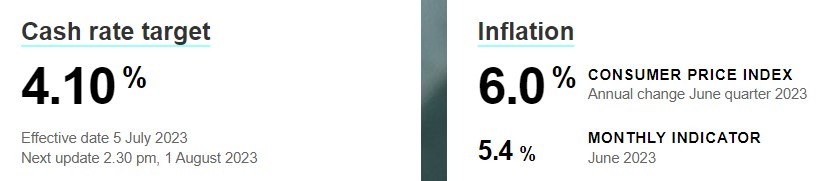

The current RBA cash rate is 4.1% (see PCI above).

Of relevance today are the data for July inflation: