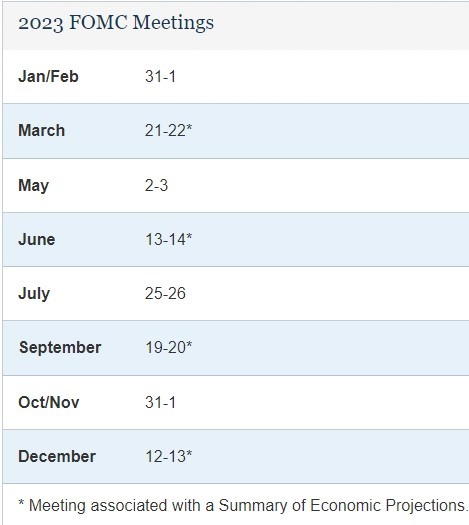

TS on their expectations for the Federal Open Market Committee (FOMC) at the next two meetings.

TD argue that the minutes of the Jan 31/Feb 1 meeting signalled that the Federal Open Market Committee (FOMC) is not yet done regarding further rate hikes, and it is looking to maintain a restrictive policy stance for the foreseeable future.

TD forecast:

- 25 bps rate hikes in March and May

- terminal Fed funds target rate range of 5.00%-5.25% hit in May

And warn:

- However, we note a sizable upside risk to our terminal rate projection, where strength in upcoming releases on CPI and PCE inflation, as well as the labor market, could sway Fed to continue to hike beyond the May meeting.

- We continue to like owning 10y Treasuries as the Fed is likely to keep policy restrictive for longer, resulting in weak growth later this year and in 2024.