The market has now moved into line with what the Federal Reserve was forecasting in the December dot plot in a rare instance of the central bank being smarter than the market. But the battle begins anew on what happens next.

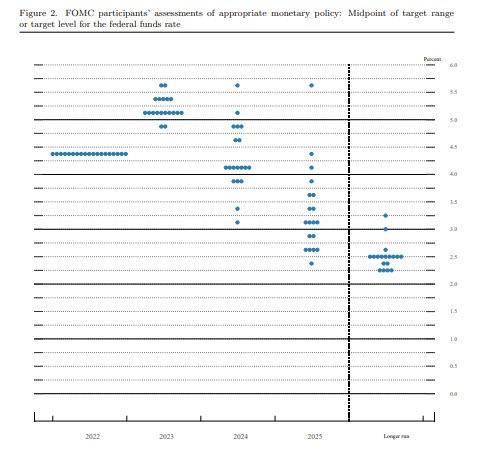

The big question for the Fed on March 22 will be where to put the new dots. Do they want to bump up the top of the range? Leave it largely unchanged? Or push a scenario where rates hold higher for longer?

I think the last scenario is still the most likely but there's plenty of room for debate.

Looking at markets, the 2-year yield is a good proxy for where the market thinks the Fed will settle and today we hit the highs of the year at 4.81%. That's still not high enough from where I stand but a further rise is going to put a 100 bps inversion in 2s-10s in play.

I think it will be worth buying the dip on risk assets (and selling the dollar if/when this gets to 5.25%. For now though the momentum here and in the dollar is higher.

More-specifically, Fed fund futures today hit 4.82% but have since pared back to a peak of 3.39% in July, presumably after the comments from Fed hawks Mester and Bullard didn't push for more hikes.

As for the upcoming meeting, the odds of 50 bps are at 24% with the remainder at 25 bps.