Sound words of advice

Josh Brown on CNBC said as he and Brad Gerstner of Altimeter Capital discussed the markets, (and I paraphrase):

The person you want to run away from now is the person who KNOWS what will happen.

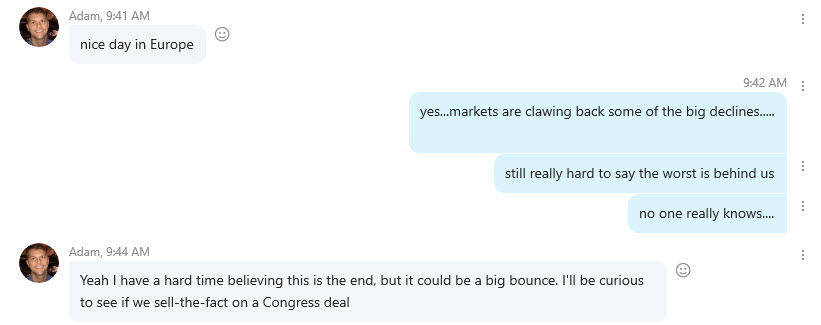

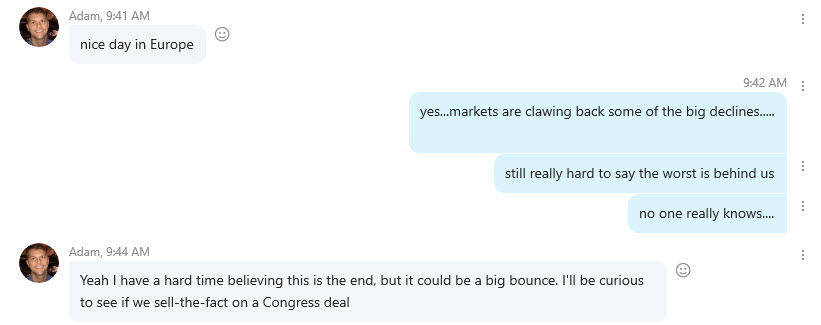

Just before that Adam and I were chatting and shared these simple thoughts:

The fact is we are grasping at straws and hoping. In fact, the first words I typed today were:

The GBP is the strongest and the USD is the weakest as NA traders enter for the day as stocks (and yields) move back higher on hope. Hope for a stimulus package passage, hope that the Fed's stimulus helps the economy, hope that the virus does not get too outta hand, and hope that the deficits being built will one day ease.

Yes... "Hope" is part of trading. No one "knows" for sure, or even close to "knows", what will happen - especially now. We will, and should have a "hard time believing".

Now when the dust settles, there will be those that "knew all along". Fine. Have your day on twitter or in a comment. However, if you did not include a level of risk...you are just flipping a coin in my eyes.

For me, I would rather remain humble and listen to those that are humble who understand where they are wrong.

I will also base my thoughts on what I see in the charts, because it tells a story to me. That story has included in it, a lot of "IFs". In fact, in a post earlier today titled "The USDJPY remains in the middle of the 3 day range. Buyers keep more of the bias", I wrote:

Intraday, the price action is up and down today. The lows have stalled along a trend line. The price is trading around the 50% of the move down from yesterday's highs at 110.828. The price is above the 100 and 200 bar MAs at 110.543 and 110.63 currently. The price has been able to stay above the 200 bar MA since breaking about an hour or so ago. If the price can stay above the 200 bar MA (green line), that keeps the buyers in control intraday. Move below the 200 and 100 bar MA (blue line) and the intraday sellers are back in firm control.

The last two sentences are my way of saying "I don't know" or "I hope". However, the "IF" is my way of also saying "That is my stop area. Things are good as long as that condition remains true."

Some people don't like that. Some people are not like that. They feel that you have to have a "conviction". "Buy.... it is going up" or "Stop with all the "IFs.".

My response is "What makes me know more than "the market"? What makes my crystal ball so much clearer than all the others out there?" Don't be silly.

What I know is what I see. If I see it in the chart, my feeling is others from all around the world can see it too. In fact I try to make it simple to all (or those that read my posts). I post what I see (post the chart(s)). I comment on what I see with arrows and words, but do "I know for sure?" NOPE! It is contingent on the "IF the price stays above the.....blah, blah, blah".

The point is traders, if you KNOW what will happen, run away from yourself. Instead, find where the "IFs" are that will tell you where you are wrong, and you will have the right mindset for trading.