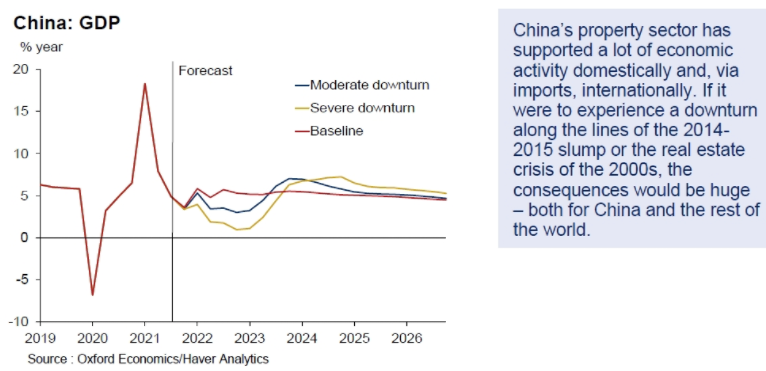

Oxford Economics say that a more severe downturm in China's housing market

- would slow China's growth markedly

- and have a major impact on global growth

If the downturn copied the US and Spanish property crashes of the 2000s, Chinese growth could plunge as low as 1% y/y by end-2022.

OE accompany with this:

---

Chinese authorities would do what they can to prevent this from happening. Whether they'd be successful is the question I guess. They are currently in the process of a controlled implosion of Evergrande and other property companies, dismantling bit by bit.