Sterling outlook given Brexit and Bank of England developments, this via ANZ client note

(in brief, bolding mine)

transition deal agreed by the EU and the UK has reduced the likelihood of worst case outcomes from trade talks between the EU and UK

- tail risk recedes

- sterling may become more responsive to UK economic data

That said, we do not think that the transition agreement justifies a further reduction in the risk premium that arose after the Brexit vote

- Instead it may stabilise around current levels

- one of the major consequences of this 'risk premium' is that the sensitivity of the GBP to real-yield differentials has fallen dramatically

Recent Bank of England (BoE) communication suggests

- if the data continues to hold up well, then the expected path of rate tightening steepens, with a hike possible as soon as May

- this is largely priced

- as such, it justifies current levels in the GBP rather than being a catalyst for further sustained strength

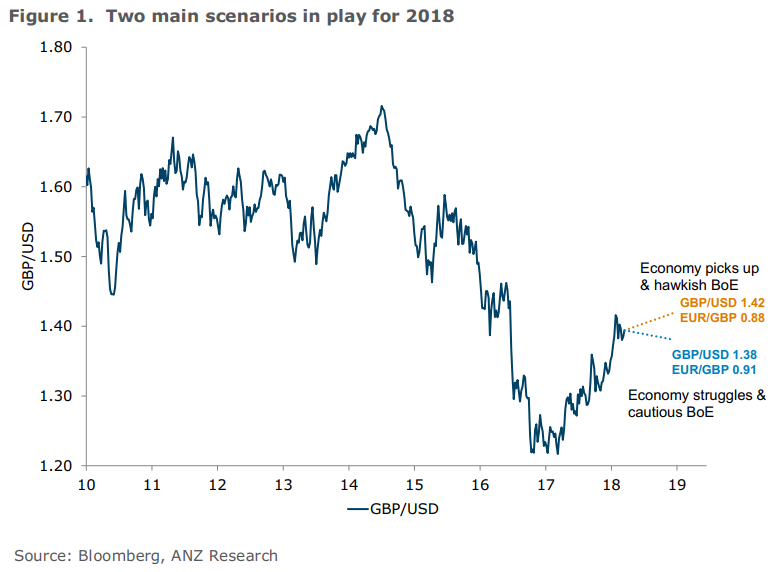

These two points combined suggest that even if the BoE steps up its tightening path over the coming months, sterling is unlikely to appreciate much. Our baseline scenario is for sterling to peak around 1.45, so further upside is looking limited.

More:

- Our analysis shows that there is a higher risk premium in sterling post the referendum. Importantly, the sensitivity of GBP to interest rate may have declined. This structural change is likely to remain, owing to ongoing uncertainty over future UK international trade in goods and services.

- Also, recent trends in capital and FDI balances suggest some further downside pressure for sterling will materialise, especially against the euro.

- Given all of the above, GBP should peak ahead of 1.45 (and 0.88 should be the lower bound for EUR/GBP), even if the scenario of a BoE stepping up its tightening cycle.