The aussie is the weakest major currency on the day

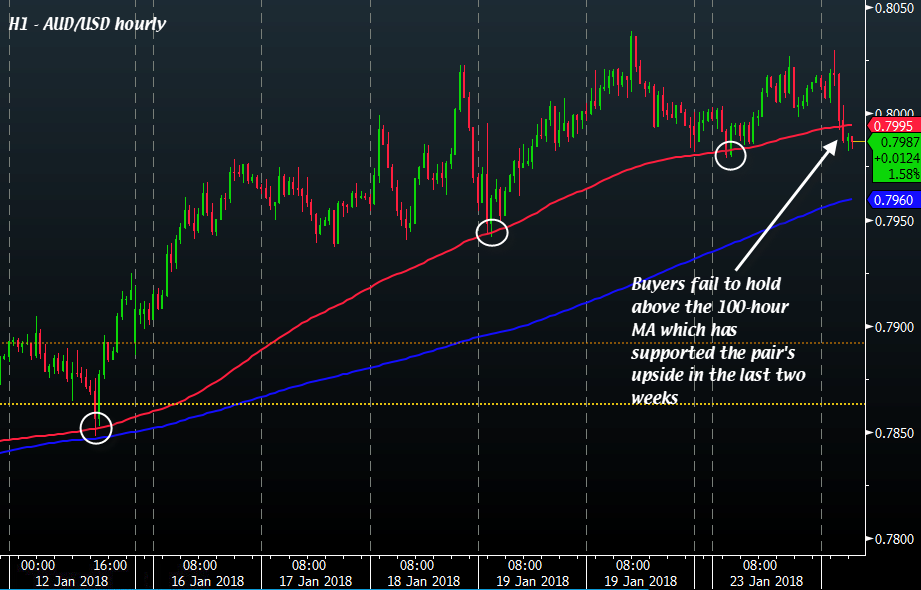

Spot declines against the dollar and the kiwi isn't helping the aussie today. Buyers seem to be exhausted as AUD/USD touches above the 0.8000 level and now we've fallen below that. But more importantly, the key support level which has been holding the pair up in the last two weeks has also given way.

The 100-hour MA has proved to be a pivotal support level for buyers in the run up recently, but today sellers managed to find a way to break past it for the time being. We're now caught in a crossroad for the pair, but the signs of a possible crack in the bullish momentum doesn't offer much optimism for buyers right now.

AUD/USD is still finding some support from yesterday's lows of 0.7979 but if that breaks the next level to look out for will be the 0.7950 level where there was some consolidation last week in that region before the run up to 0.8000.

Looking at AUD/NZD, the same exhaustion story applies. Buyers made a run up towards 1.1000 but got rejected near the 61.8 retracement level hovering at 1.1003. The 100-day MA has been a stubborn resistance level for buyers over the last two months, and until buyers can stay above that - this is pretty much still sellers' territory.

The hourly chart tells an even bleaker story. The pair formed a double top at the highs of last week and is now falling all the way back down as sellers break through the 100 and 200-hour MAs with relative ease.