February retail trade data is due today, Wednesday 4 April 2018 at 0130GMT

Preview via Westpac:

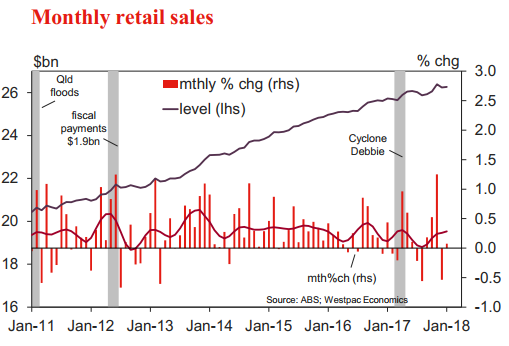

Retail sales posted a disappointing start to 2018

- a 0.1% gain in January only partially retracing a 0.5% decline in December which in turn followed a solid rebound in October - November from a weak Q3

- Annual growth slowed to a sub-par 2.1%yr

- The subdued result comes despite a firmer backdrop for consumer sentiment and suggests the step-up in price competition associated with the launch of Amazon's Australian retail operations late last year remains a restraining factor on nominal sales

Retailers may have fared a little better in February:

- While price competition remains fierce and consumer sentiment softened a touch, retail sector responses to the NAB business survey showed a lift in conditions over January - February to the second highest reading since late 2015

- However, the AiG PSI points to much weaker conditions for retail.

- On balance we expect February to show a 0.4% gain. Note that the survey should include Amazon Australia's retail sales.

via ANZ:

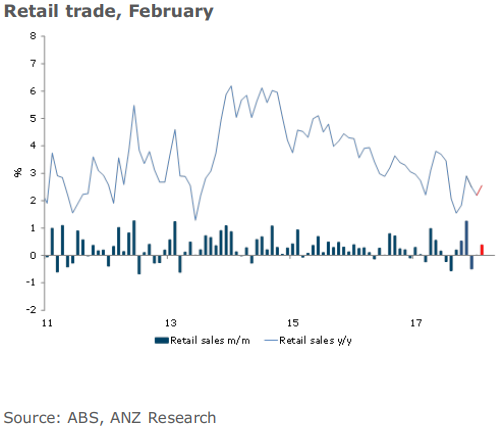

- We expect a solid rise for retail trade in February, following the disappointing January outcome.

- Anecdotes suggest sales have been strong.

- In addition, petrol prices continued to fall and consumer confidence remains well above end-2018 levels.

- The changing pattern of sale events appears to have impacted consumer behaviour in recent months, leading to some volatility in the monthly retail trade numbers.

NAB:

- NAB is expecting strong monthly growth of 0.7%, following strength in the NAB Cashless Retail Sales Index and current budget numbers that indicate GST receipts have risen

- Retail sales data has been volatile of late, and the implications for consumption harder to read, as changing sale seasons and a shift to online retailing have impacted seasonal patterns

- Nevertheless, given that retail sales remains a key indicator for consumption growth, the markets will be watching closely.