Official Australian inflation data is due today for the January to March quarter of 2019. Coming up at 0130GMT on 24 April 2019.

Earlier:

- Australian Q1 CPI preview - core inflation to weaken, meeting RBA criteria for a rate cut

- Australian Q1 CPI is due Wednesday 24 April - preview

The numbers (from earlier also):

Headline CPI

- expected is 0.2% q/q

- prior was 0.5%

- y/y expected 1.5%, prior 1.8%

Trimmed mean -a core inflation measure

- expected 0.4%

- prior 0.4% q/q

- y/y expected 1.7%, prior 1.8%

Weighted median - the other core measure:

- expected 0.4%, prior 0.4%

- y/y expected 1.6%, prior 1.7%

Quickie what-to-expects via:

BNZ:

- consensus sees a soft outcome

- that would help reduce a hurdle for potential RBA rate cuts this year, although the Bank seems more attune to labour market developments and last week's decent employment report won't rush the RBA into cutting rates ahead of the May Federal election

Westpac:

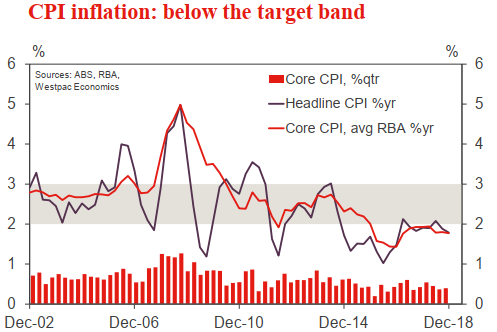

Consumer inflation undershot the RBA's 2-3% target band in 2018

- Key to this lack of price pressure are: weak wages growth; a housing downturn; sluggish consumer spending; and intense retail competition.

- While the AUD has weakened the pass through of higher import prices to consumers is limited.

we expect headline inflation of only 0.1%qtr 1.4%yr.

- Additional forces at work in the period are: retreating fuel prices... and a seasonally soft quarter

Core inflation is expected t... 0.3%qtr … 1.6%yr.

- Core inflation is to remain well below the bottom of the RBA target band as moderating housing costs hold back modest inflationary pressures elsewhere. Overlay a competitive deflationary pressure in consumer goods and it is hard to see core inflation breaking much higher any time soon.

Graph also from Westpac: