National Australia Bank Business Survey, February

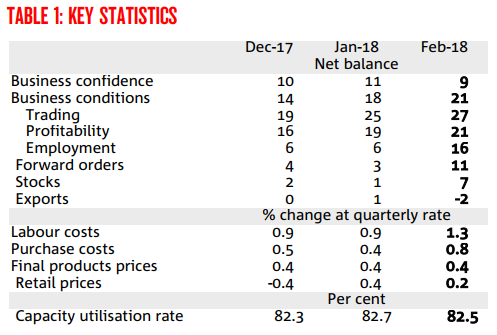

Business conditions 21 ... doing well ... to a record high

- prior 18, revised from 19

- Long run average of this is 5

- Conditions strongest in construction, mining, finance, and property & business services

- Retail sector - highest reading in 8 months

Business confidence 9

- prior 11, prevised from 12

- NAB citing concerns over financial market volatility impacting on this measure of sentiment

Some of the sub indices:

- profitability+2 points to +21

- sales index +3 points +27

- employment index +10 to +16 )16 is a record high for this)

- forward orders +3 to +11

NAB comments

- strength in activity broad-based

- all major industry groups reporting above-average conditions,

- If the recent surge is sustained, the employment index points to a robust level of jobs growth of approximately 27,000 per month

- Historically, NAB Business Survey employment has tended to lead the official data by six months

- suggests that the strength in employment growth will not be ending any time soon

NAB chief economist Alan Oster:

- new orders at this level is consistent with non-mining domestic demand growth approaching 6 percent

- The strength in business conditions and leading indicators makes us more confident that Australia will see stronger economic growth in coming quarters

Reserve Bank of Australia implications:

- We expect by late 2018 the RBA will feel relaxed enough about the domestic fundamentals to cautiously start withdrawing the stimulatory policy stance it is currently running

---

AUD edging a little higher, expect the first resistance level to give way soon

---

For more on this, background etc: