ArticleBody

Westpac preview:

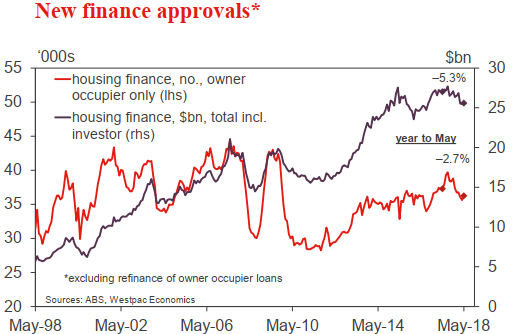

- Australian housing finance approvals were firmer than expected in May, the number of owner occupier loans rising 1.1% and the value of investor loans up 0.1% in the month. The result was against the wider 'run of play' for housing markets - auction activity and prices both pointing to a further softening through the middle of the year.

- Finance approvals should reconnect with the wider market picture in June although specific indicators are a bit mixed. Industry data covering the major banks suggest seasonally adjusted approvals posted a rise in June, but were much weaker than the ABS figures in May. Other indicators tracking wider mortgage activity look to have better captured the May resilience and point to some softening in June that accelerated in July. Overall we expect owner occupier finance approvals to show a 1% decline with a clearer weakening showing through in July. Note that as well as more stringent lending criteria, some of this will reflect delays due to longer processing times.