Some analyst responses to the Australian Q4 wage price index figures that was released earlier in the day

The data was released here. Here are some responses to the data point:

Commonwealth Bank of Australia (Kristina Clifton)

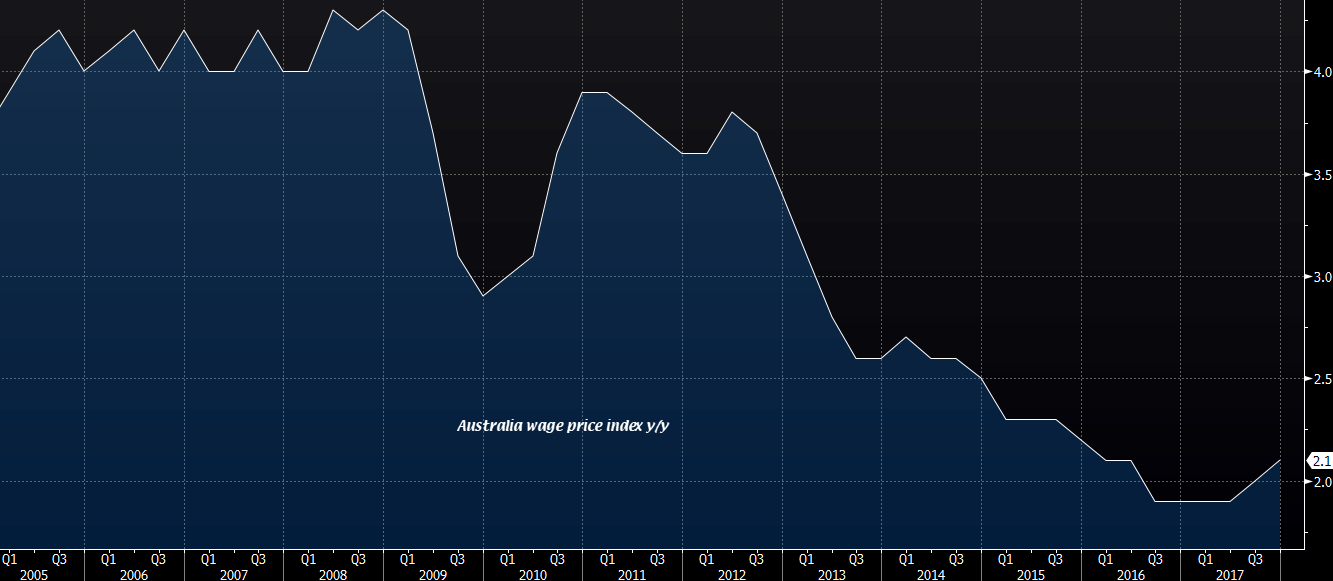

It looks like the much awaited pick up in wage growth may finally be here after mostly sub-0.5% quarterly outcomes since late 2015. This makes sense given the strong run of jobs growth over the past year or so and the easing in the unemployment and underemployment rates.

What really matters for household balance sheets is real wages growth. Real wages growth is only just in positive territory. Essentially flat real wages growth and high household debt levels are a difficult combination for consumers to navigate.

It's early days though and annual wages growth is well below the 3.5% rate that the RBA has defined as "normal". This reinforces our view that the RBA will be in no hurry to raise interest rates. We have a rate hike pencilled in for Melbourne Cup day in November.

JP Morgan (Tom Kennedy) - the headline title is via his reportWhile wage pressures are starting to emerge across various developed economies, most notably the US, we believe it is premature to expect such a scenario to play out in Australia. Indeed, the unemployment rate remains comfortably above 5% - the common estimate of NAIRU - and underemployment is still close to all-time highs.

Both of these measures indicate excess capacity across the labour market and, all else equal, suggest wage growth will remain unimpressive for some time yet.

ANZ Bank (Felicity Emmett)

The RBA is likely to be comfortable with the data, although we expect that, like us, it would be hoping for some improvement in private wage growth in Q1. RBA Governor, Philip Lowe, in his semi-annual testimony to parliament on 16 February noted, "If we're going to deliver average inflation of 2.5% we should probably have average wage increases over long periods of time at 3.5%". Wage growth is still a long way away from 3.5%, but it now looks to be convincingly heading in the right direction.

The consensus seems to be that wage growth remains slow and that there is still excess capacity in the labour market, which is likely to mean that there won't be a pick up in wages towards the 3.5% level (RBA's so-called "normal" level) any time soon.

With that in mind, it still remains that the RBA is unlikely to be in a hurry to raise the cash rate and the uncertainty surrounding when they may proceed to do so continues on.