Fourth quarter economic growth in Australia, how the economy was tracking heading into a tough Q1 2020.

0.5% q/q for a beat

- expected 0.4% q/q, prior 0.4%

2.2% y/y and also a beat

- expected 2.0% y/y, prior 1.7%

More:

- Government spending > than half of the growth figure y/y

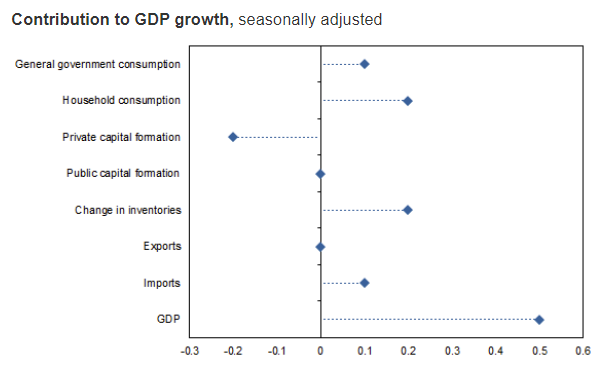

You can see the quarterly inputs here:

The following points are summarised from the ABS' main points:

- Domestic demand remained subdued

- pick up in household discretionary spending

- continued increase in the provision of government services

- falls in dwelling and private business investment

- Fall in dwelling investment, the sixth consecutive fall … consistent with the decline in construction industry value added

- housing market recovery is evident in the increase in ownership transfer costs ...these are things like paying real estate agents, stamp duty, conveyancing … this all added up to more of Q4 GDP than all business investment combined … lack of capex does not auger well going forward.

- Household income remained steady with compensation of employees recording its twelfth consecutive rise, increasing 1.0 per cent during the quarter ... reflects a rise in the number of wage and salary earners as well as a steady increase in the wage rate

- household saving to income ratio was 3.6 per cent, driven by the subdued consumption coupled with steady increases in wages and a boost in insurance claims.

- Mining industry provided additional strength to the economy, with growth in production volumes of 1.6 per cent, strengthening through the year to 7.3 per cent.

- This was reflected in the growth in mining exports and inventories.

- Falling prices for key export commodities impacted the terms of trade in the December quarter, which fell 5.3 per cent. This reduced nominal GDP, which fell 0.3 per cent, as lower coal, iron ore and gas prices contributed to more subdued company profits.

- Mining profits declined 2.6 per cent for the quarter.

- Real net national disposable income declined 0.9 per cent.

A mix of negatives and positives in there. On balance the report reflects the headline results, slight better than expected. Q1 2020 is going to a tough one what with the bushfires and then the virus impact, but at least going into it is a little better than was thought.

--

Background here: