Official CPI from Australia comes only four times a year, once a quarter.

Wednesday 28 July 2021 will bring the Q2 data, due at 0130 GMT.

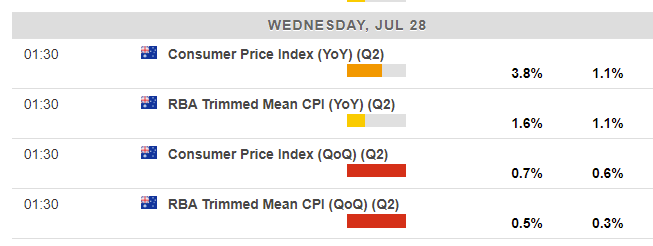

Expected (first number) and prior (second number) from our calendar ... and I'll have more on these on approach to Wednesday:

(ps. RBA trimmed mean refers to the data published by the Australian Bureau of Statistics, not the RBA itself, although its what the Bank looks at - its a core rate of inflation measure).

Comments via NAB (in brief):

- expects another subdued print

- base effects though will see the Headline y/y rate hit 3.6% y/y, but the effect will fade next quarter.

On implications for the Reserve Bank of Australia (Bolding mine):

- Look forward, Sydney's lockdown will also likely see a subdued Q3 CPI print and speculation continues that the RBA will reverse its QE taper at the following week's August meeting.

(National Australia Bank referring to the August 3 policy meeting)

And, via ASB:

- Q2 CPI figures will be worth watching as they will give us an idea of what inflationary pressures may have been brewing in the lead up to the latest lockdowns. This is important when assessing the outlook for inflation in 2022.

- Our forecast is for the headline CPI to increase by 0.7% in Q2 21 which would see the annual rate spike to 3.8% (recall that the Q2 20 CPI fell by 1.9% in large part because of free childcare). The trimmed mean will rise by 0.5% which will push the annual rate up a touch to 1.6%