A 43% arbitrage trade in Bitcoin is not as easy as it looks

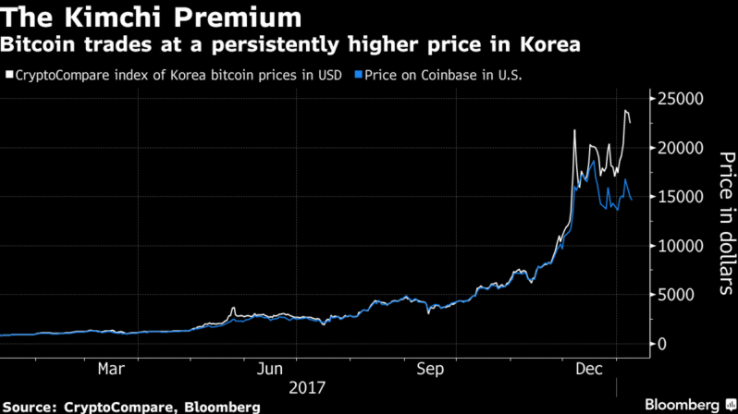

Bitcoin prices in South Korean exchanges trade at over 43% higher than those in the US. Simple thinking suggests buy Bitcoin in the US and then sell them in South Korea, no? If only it were that simple.

The price gap which is also known as the "kimchi premium" is one that local traders are finding it difficult to take advantage of due to South Korea's FX and anti-money laundering regulations.

The first step for local traders is that they must exchange their KRW into foreign currencies to purchase Bitcoin in overseas' exchanges, but FX regulations make it difficult in that regard.

Local residents and companies moving more than $50,000 out of the country in the calendar year are subject to documents submission to local authorities proving their reasons for such transfers - which may not always be approved. Given the crackdown by regulators in South Korea on cryptocurrencies, there would be absolutely no chance something like this gets approved.

Apart from that, anti-money laundering inquiries could be triggered when such transactions are made and that's not something traders would want hanging over their heads when dealing with a simple arbitrage trade.

The other risks involved is that the transfer of Bitcoin between exchanges aren't instantaneous - and that could subject traders to adverse price swings during the transfer.

But in spite of all of that, there are potential workarounds. A financial analyst in Seoul says that he has profited from the "kimchi premium" by purchasing ether in Korea, transferring it to an offshore venue and then exchanging it for Bitcoin, and then transferring the Bitcoin back to Korea. Although, that only works if the ether premium in Korea is smaller than the Bitcoin premium.