From Bank of America / Merrill Lynch on the USD, a few snippets

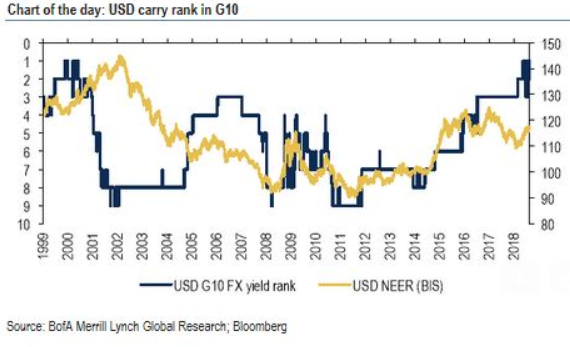

US dollar resides firmly on the asset side of the FX carry spectrum

its presence atop the yield ranking is historically atypical and a reflection of

- a robust US economic cycle

- and a steadily hiking Fed

- attributes that have supported USD higher since 1Q18

USD asset status alongside SEK liability status (displacing JPY) has also sharply shifted historical FX carry correlations. resulting in long carry positions now having very low traditional 'beta" (risk-on/risk-off exposure as well as long exposure to implied volatility.

event analysis suggests FX carry is poised to make another run higher in the weeks ahead. Of key importance will be whether recent sharp depreciation in AUD and NZD - the two other asset currencies aside from USD - moderates