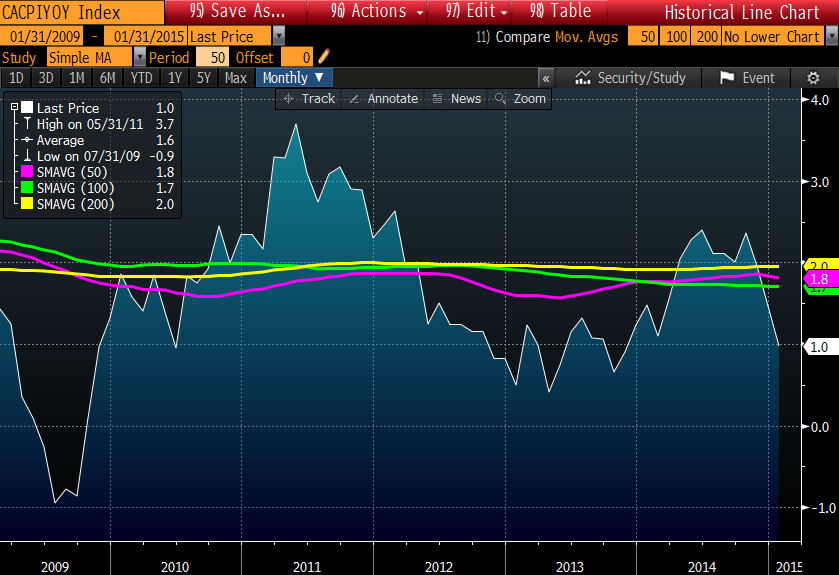

Canadian inflation data for January

- Core YoY 2.2 vs. 2.1% est

- MoM -0.2% vs. -0.4% est

- Core MoM +0.2% vs +0.1% est.

The inflation numbers out of Canada for the month of January were higher than expectations. The headline reading tumbled on the monthly change but it will be comforting for the Bank of Canada to see the core measure tick up slightly.

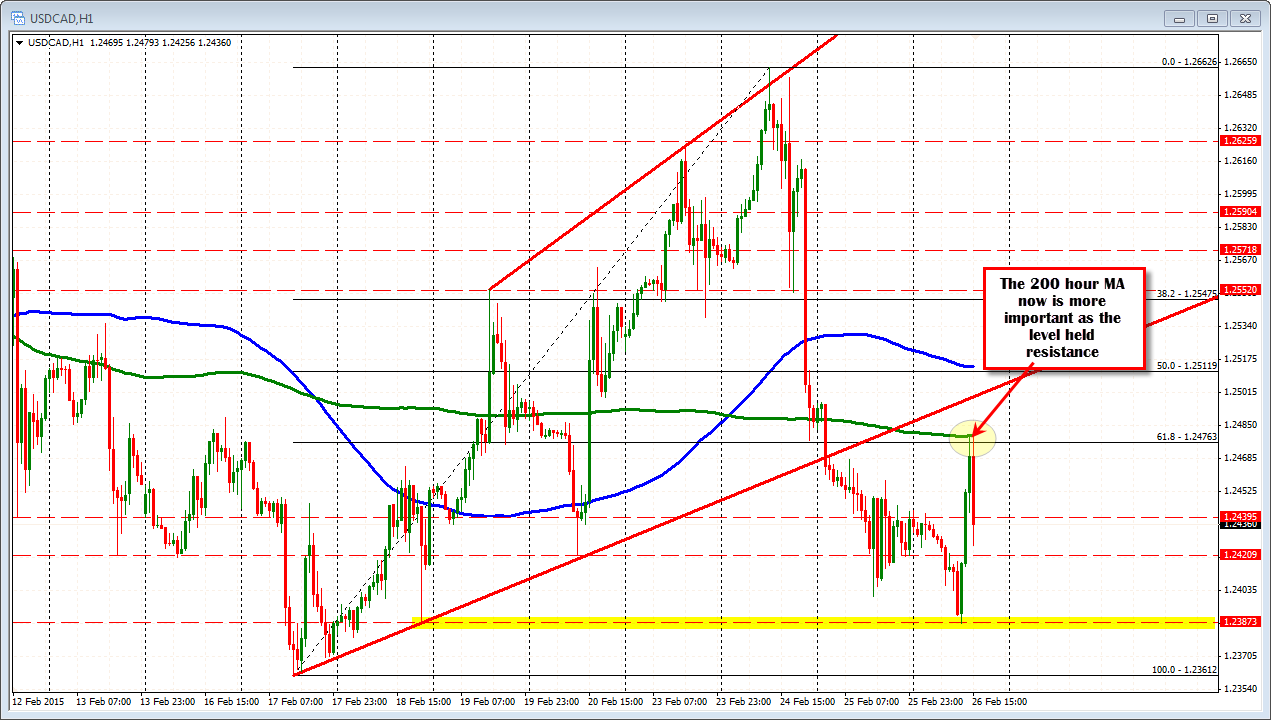

The USDCAD has fallen around 50 pips on the news.The pair held resistance against the 200 hour MA above which will now increase that levels importance going forward (green line in the chart below).

There is nothing in the report that would force the Bank of Canada to cut rates in March. The headline m/m change was poor but Poloz is likely to see that as transient. The OIS market is seeing at 32.8% chance of a Bank of Canada rate cut next week, compared to 85% last week and 36.6% yesterday.

.