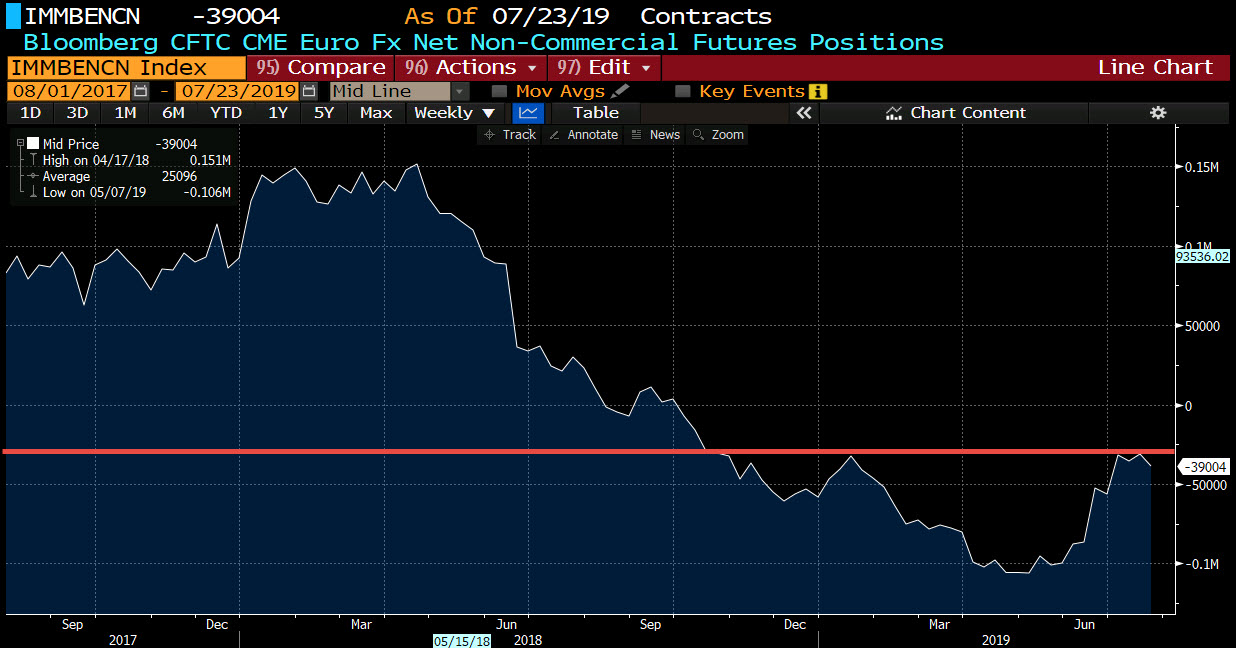

Forex futures positioning data among noncommercial traders for the week ending July 23, 2019

- EUR short 39K vs 31K short last week. Shorts increased by 8K

- GBP short 79K vs 76K short last week. Shorts increased by 3K

- JPY short 9K vs 11K short last week. Short trimmed by 2K

- CHF short 13k vs 12k short last week. Shorts increased by 1K

- AUD short 48 k vs 53k short last week. Shorts trimmed by 5K

- NZD short 12K vs 17K short last week. Shorts trimmed by 5K

- CAD long 31K vs 21K long last week. Longs increased by 10K

- Prior week

Highlights:

- GBP shorts remain as the largest position. The GBPUSD moved to new 27 month lows today rewarding those traders.

- AUD shorts are the 2nd largest position and the AUD moved to new month lows today retracing the run higher from the June 10 low

- The EUR shorts increased by 8K. The EURUSD moved modestly lower this week. The EUR short has been cut from over -100K short to 31K (the fall in short positions seems to have slowed over the last month.

- Speculators remain long the CAD. It is the only major foreign-currency long position versus the US dollar