Forex futures positioning for the week ending October 27, 2020.

- EUR long 156K vs 166K long last week. Longs trimmed by 10K

- GBP short 7K vs 2K short last week. Shorts increased by 5K

- JPY long 18K vs 14K long last week. Longs increased by 4K

- CHF long 15K vs 14K long last week. Longs increased by 1K

- AUD long 9K vs 7K long last week. Longs increased by 2K

- NZD long 7K vs 6K long last week. Longs increased by 1K

- CAD short 18k vs 19K short last week. Shorts trimmed by 1K

- Prior report

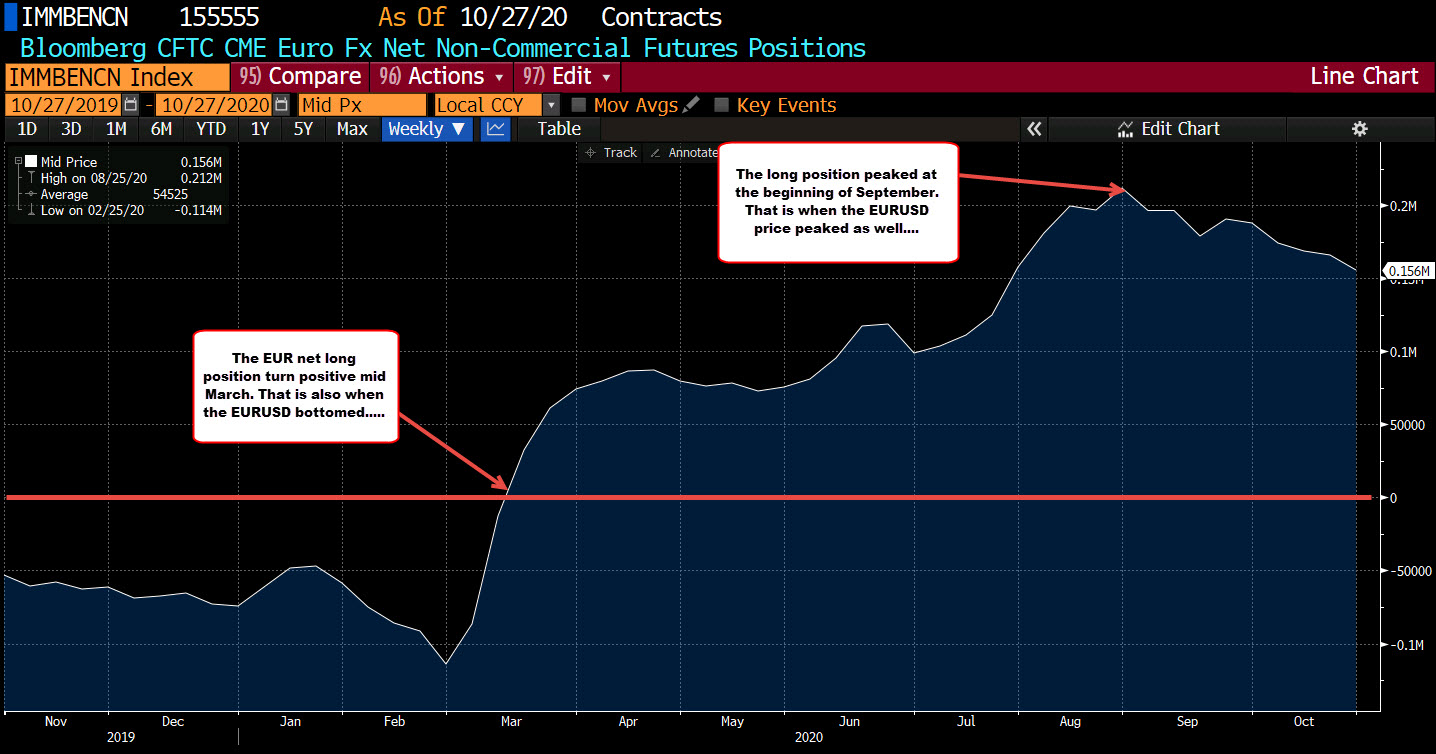

Net positions remained relatively modest with the exception of the long in the EUR. Although still large at 156k, that position is down from a record long level of 212K from the 1st week of September.

The EUR position turn positive in the middle of March. The price peaked on September 1 which corresponded with the largest long position as well. Send the position as 100 lower along with the price of the EUR. So in reality, the net position has been congruent with the markets movements.

The next largest position is long 18K JPY and short 18K in the CAD.