Forex futures market speculative positioning data from the CFTC Commitments of Traders report as of the close on Tuesday 12th August 2014:

- EUR net short 126K vs short 129K prior

- JPY net short 81K vs short 95K prior

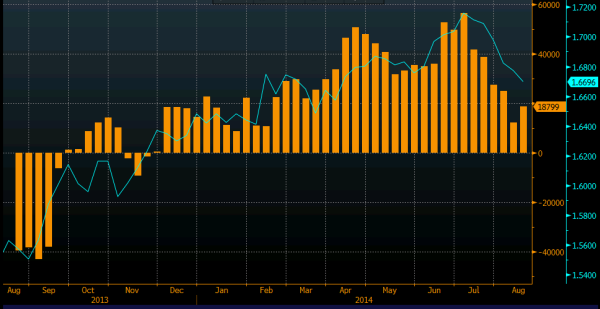

- GBP net long 19K vs long 12K prior

- AUD net long 30K vs long 33K prior

- CAD net long 18K vs long 21K prior

- CHF net short 17K vs short 19K prior

- NZD net long 13K vs long 15K prior

Eureka! My theory works…sort of. A reduction in positions in all bar the pound and there might be a few lighter pockets after the the drop we had on Wednesday after the jobs and inflation reports.

Euro shorts were trimmed slightly too and that may have been a lack of patience as the euro stubbornly held around 1.3330/3400

CFTC GBP net longs 15 08 2014