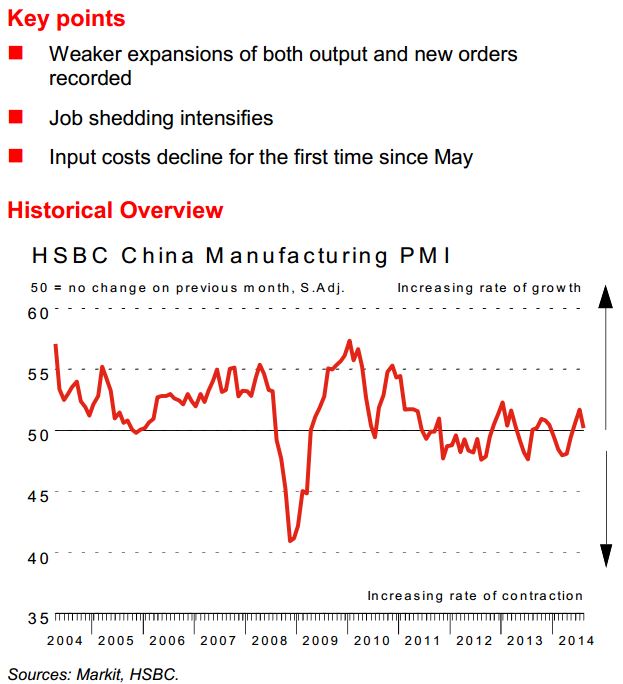

China HSBC/Markit Manufacturing PMI for August, 50.2

- expected 50.3,

- prior was 51.7,

- flash reading was 50.3 (to a 3-month low)

- Pace of improvement eased to a fractional pace

- Both output and new order growth slowed and job shedding in the sector persisted

- Input costs declined for the first time in three months while increased competition for new business led manufacturers to reduce their selling prices

- After adjusting for seasonal factors, the HSBC Purchasing Managers’ Index™ (PMI™) – a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy – posted at 50.2 in August, down from July‟s 18-month high of 51.7

- This signalled only a fractional pace of improvement that was the weakest in three months

- The decline in the headline index partly reflected slower expansions of both output and total new business during August

- The rates of production and new order growth were moderate overall, having eased from 16- month highs in July

- Data suggested that client demand softened both at home and abroad, as new export work also rose at a weaker pace in August

- While some panellists mentioned that improving market conditions and new client wins boosted new work intakes, others commented on relatively subdued client demand

- As has been the case since November 2013, manufacturing firms in China continued to reduce their staffing levels in August. Furthermore, the rate of job shedding was the quickest in three months and moderate overall

- Companies that reported lower workforce numbers partly attributed this to the implementation of cost reduction policies. Despite lower staff numbers, backlogs of work rose for the third successive month in August, albeit marginally.

Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC:

- “The HSBC China Manufacturing PMI eased slightly to 50.2 in the final reading for August from the flash reading of 50.3.

- The revisions were mixed, with upward revision to the new export orders and output sub-indices but downward revisions to the employment and input prices indices.

- Although external demand showed improvement, domestic demand looked more subdued.

- Overall, the manufacturing sector still expanded in August, but at a slower pace compared to previous months.

- We think the economy still faces considerable downside risks to growth in the second half of the year, which warrant further policy easing to ensure a steady growth recovery.”