Bloomberg reports on the matter

The report highlights that Chinese refineries are cutting back on output even further to cope with weak demand and a lack of workers due to the coronavirus outbreak.

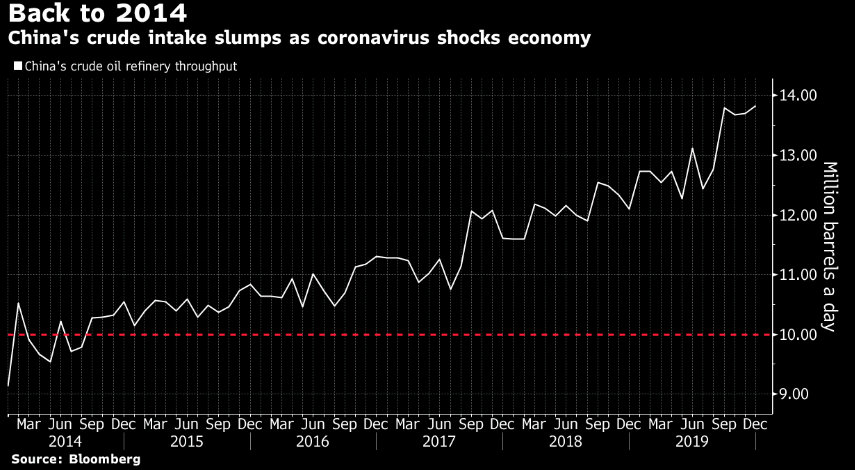

Throughput is now reported to be 25% below the average in 2H 2019 and the low run rates are expected to last through February at the very least. The run rates have fallen to just about 10 mil bpd this week - the lowest since 2014.

That certainly won't give oil bulls much encouragement and this is another warning sign to overseas oil suppliers to China surely.

This headline alone may not be one that impacts the market too heavily but just note that all of these things add up when you weigh up the potential impact of that the coronavirus outbreak is having on the global economy.