- Prior 2.1%

- 0.4% vs 0.5% exp m/m. Prior 0.1%

- Core 1.7% vs 1.8% exp y/y. Prior 1.8%

Retail prices

- RPI 0.5% vs 0.5% exp m/m. Prior 0.1%

- 2.7% vs 2.7% exp y/y. Prior 2.6%

- RPI ex-mortgage interest payments 0.5% vs 0.6% exp m/m. Prior 0.1%

- 2.8% vs 2.8% exp y/y. Prior 2.7%

- Index 253.4 vs 253.6 exp. Prior 252.1

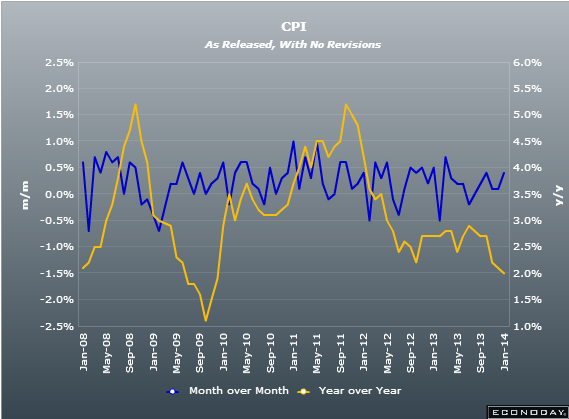

CPI hits the BOE 2.0% target for the first time since Nov 2009. Retail

Some upward pressure from fuels rising to 0.5% from -1.2% in Nov. Utilities also gain to 2.3% from 0.0% prior and to 3.4% from 3.4% y/y. Food leads the Core lower with a fall to 1.9% y/y from 2.8%, although there was a small rise on the month 0.3% from flat in November.

The ONS points to seeing some upward pressure coming in from utilities rising and we’re getting price rises kicking in soon which will add to that further.

As usual the all important core number has dropped further and that’s the one that we need to keep an eye on. The BOE will be happy to be back at target but we need to make sure we don’t continue lower otherwise the market may start looking for some policy action. We’re a way off from that at the moment though.

GBP/USD lost 50 odd pips from 1.6448 to 1.6398. EUR/GBP crapped out to 0.8316 but has recovered to 0.8340.