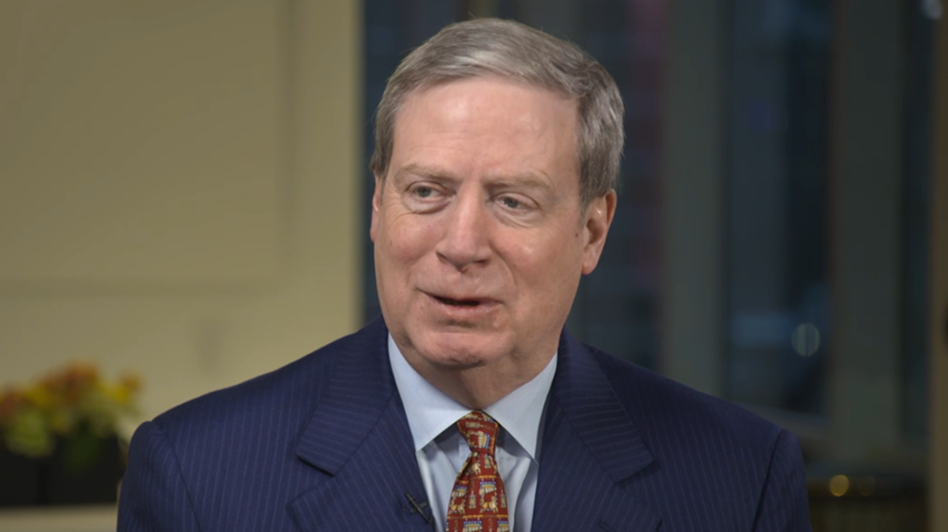

FX trading legend on CNBC

- I can't find any period in history where monetary and fiscal policy were so out of step with economic circumstances

- In six-weeks we did more QE than the entire 9-year financial crisis

- The Fed is expected to do $2.5 trillion in QE after vaccines and retail sales hit trend

- We're still acting like we're in a black hole but retail sales are 15% above trend

- My central case is that the dollar loses reserve status to be replaced by some kind of crypto ledger

- The Fed is monetizing fiscal easing, without the Fed buying the bond markets would be totally rejecting this

- If the 10y goes to 4.9%, the interest expense alone will be 30% of GDP alone. What will have to happen is the Fed will have to monetize it

- The reason the dollar didn't go down because outflows from bonds were offset by a massive inflow into US equity market -- tech in particular

- Pressure on the dollar will continue to vaccine rolls out

- Says he was up 42% last year and 17% so far this year

- I have no doubt we're in a raging mania in all assets and I have no idea when it will end

- We are still long the stock market, though not as long as 4-5 months ago

- We've shifted a lot of our bets into commodities and interest rates

- I would be surprised if we're not out of the stock market by the end of the year

- It's not probably in my mind that ethereum will be the ultimate winner

The comments are a follow-up to an op-ed he wrote in the WSJ on the same topic. Given the tone in the broader market today, this is the kind of interview to send a shiver down your spine.

Tech looks like it's going to be taken to the (Cathy) woodshed today, with Tesla down 8%.