Eurozone inflation data for January on the agenda today

The dollar reversed gains in US trading yesterday, with commodity currencies surging back higher with the kiwi leading the charge - helped by better unemployment data in Q4. That comes alongside a more positive risk mood as equities rallied.

Asian equities are slightly higher on the day as US futures are keeping higher once again, with S&P 500 futures up 0.3% and Nasdaq futures up 0.5%.

Meanwhile, the short dollar squeeze is now running into some key challenges with EUR/USD bouncing a little after nearing a test of 1.2000 yesterday - the low hit 1.2011. USD/JPY is also keeping closer to the 105.00 handle for the time being still.

Looking ahead, the market will be more focused on risk sentiment and economic developments once again as volatility abates further following the recent retail trading frenzy - which appears to be shifting back to Bitcoin perhaps.

0815 GMT - Spain January services, composite PMI

0845 GMT - Italy January services, composite PMI

0850 GMT - France January final services, composite PMI

0855 GMT - Germany January final services, composite PMI

0900 GMT - Eurozone January final services, composite PMI

The focus here is on the final readings for France, Germany, and overall Eurozone - which should just reaffirm slightly softer tones compared to December amid tighter virus restrictions to start the year. That sets up the potential for a double-dip recession, although the market will be more keen to see how the vaccine rollout play out in the months ahead.

0930 GMT - UK January final services, composite PMI

The preliminary release can be found here. The final reading should just reaffirm more subdued conditions in general as tighter restrictions kick into gear for the UK last month - keeping a major drag on the services sector to start the year.

1000 GMT - Eurozone December PPI figures

Prior release can be found here. A proxy and lagging indicator of inflation pressures in the euro area economy. A minor data point.

1000 GMT - Eurozone January preliminary CPI figures

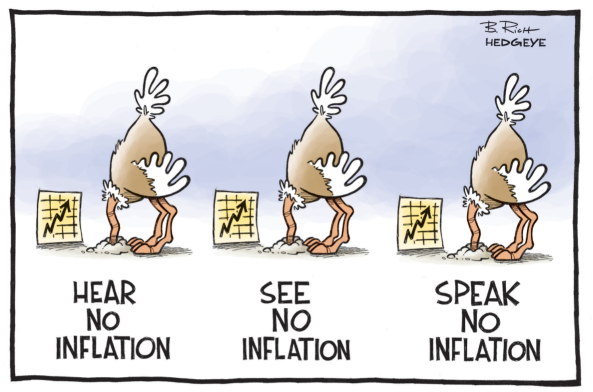

Prior release can be found here. After having seen a solid pick up in readings from Spain, France, and Germany already, the overall Eurozone reading should also reflect potential upside to the data here (headline annual inflation estimated at +0.6% y/y, core inflation at +0.9% y/y). However, it is important to put things into context. The next few months is going to be a volatile period to be trying to extrapolate much from inflation data as there will be many special factors impacting the readings. The expiring German tax cuts is one to consider alongside energy base effects as well as the change in consumption trends as virus restrictions continue to turn on and off like a switch. If anything, expect the ECB to play down any surge in inflation pressures in 1H 2021 until there is clear sight to the end of the virus crisis.

1200 GMT - US MBA mortgage applications w.e. 29 January

Weekly US housing data, measures the change in number of applications for mortgages backed by the MBA during the week. The focus will once again be on purchases as that has shown that US housing market conditions continue to run hot on lower rates, rebounding strongly after the dip during the initial impact from the virus crisis.

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.