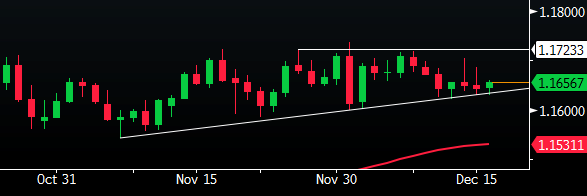

EUR/CHF is still trading within a tight wedge since November

I've always been fond of this pair, and I've highlighted that here last month.

It is a one of the few major pairs that has a more "simplistic" approach have you will when it comes to trading it.

Right now, the pair remains range-bound as you can see in the daily chart above. Today, it tested the support on the lower end and is finding a bid again. There's still decent pips to be had when you lean on these levels to trade. Personally, I'm a dip-buyer when it comes to this pair and if it's worth taking in 20-30 pips (against a risk of losing 5-10 pips) - that's alright with me since the wedge is narrowing.

Expanding on that, I'm also a big fan Bill Lipshcutz and his style of scale trading. For me, scale trading has certainly changed the way I trade and helped me gain an edge when it comes to the psychological part of trading.

I didn't catch the move in this pair when it was at 1.0700 or 1.1000. I caught it a bit later than that. The pair went up to 1.1600 before it came crashing down again to 1.1400 in late September.

This is where the psychological aspect of scale trading helped me. As the pair slowly went up, I scaled out longs at levels I felt uncomfortable with or when it reached key resistance/psychological levels. So when it came back down, it didn't give me any regrets or anything like "damn, I should've got out sooner" - and that's been a real revelation to my trading when I picked it up many years back.

I may not be able to catch the top, but one of my few favourite trading mantras is that "you can never go broke taking profits" - and that's enough for me. Sometimes I do revert back to the traditional way of trading with targets, but when you trade inter-day, you know the outlook changes over time and you have to adapt or in situations like this you encounter a pair with no actual resistance until the 1.2000 level - so you have to adapt your trading accordingly.

To be clear, I'm only talking about scaling out positions. Bill Lipschutz also scales into positions, but it's not something that I follow. If you want to read more on him, I'd recommend you get yourself a copy of Market Wizards. It's a really good book which really helps in learning the psychological aspect of trading. :)