Likes the lower EUR a bit

The major European indices are ending the session with gains. The markets are liking the fall in the EUR. A lower EUR makes exports more competitive and can increase inflationary pressures as well.

- German Dax rose 0.3%

- France's Cac rose 0.59%

- UK FTSE rose 0.07% (call it unchanged).

- Spain Ibex increased 0.1%

- Italy FTSE MIB rose 0.61%

- Portugal's PSI20 rose by 0.22%

In the European debt market today, yields were mostly higher.

- Germany 0.454%, up 1.1 bp

- France 0.735%, up 1 bp

- UK 1.371%, up 2.8 bp

- Spain 1.617%, up 3.5 bp

- Italy 2.105%, up 3.4 bp

- Portugal 2.428%, up 4.6 bp

- Greece 5.572%, Unchanged

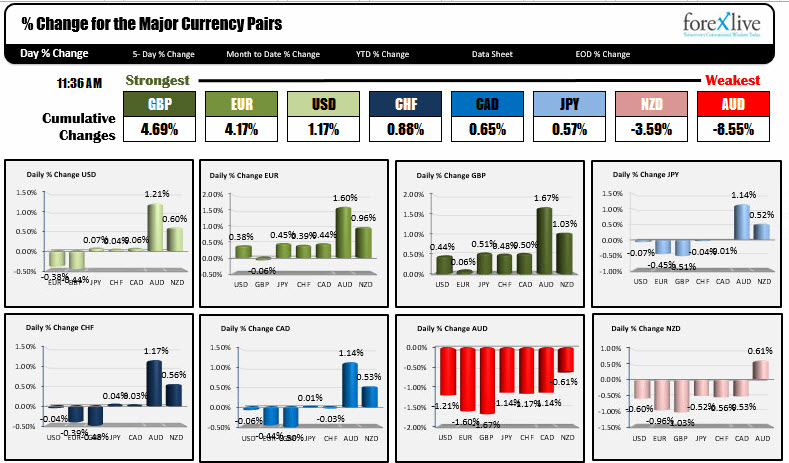

Looking at the % changes of the major currencies vs each other. The GBP has moved to the top of the table on the move higher over the last hour or so. The AUD remains at the bottom of the table.

In other markets now:

- Spot gold is down -$8.37

- WTI crude is down -$0.13 to $50.54. The low reached $50.07. The high $50.81.

- US yields are lower but modestly. 2 year 1.4302%, down -0.8 bp. 10 year 2.2570%, down -1 bp. 30 year 2.796%, down -1.1 bp

- Stock indices in the US are lower but off lows. S&P is at 2504.61, down -3.63 points. The low reached 2499.00. Nasdaq is down -21 points to 6434.73. The low reached 6405.30.