Latest data released by Markit - 5 May 2021

- Composite PMI 53.8 vs 53.7 prelim

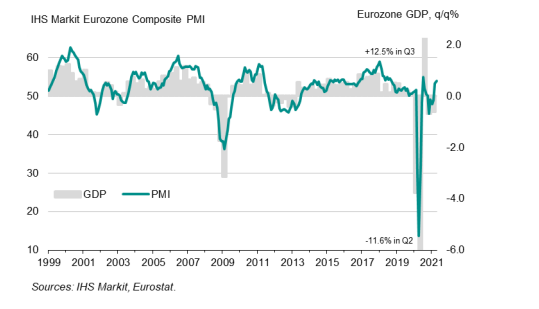

The preliminary report can be found here. The final readings reaffirm some modest resilience in the euro area economy, with the services sector returning to growth after seven months of contraction beforehand.

There were solid performances in Spain and France to add to Germany's robustness since Q1, which is largely aided by its manufacturing sector.

This does add some optimism going into 2H 2021 if vaccinations gather pace and the virus situation is kept under control, paving the way for a summer reopening perhaps.

Markit notes that:

"April's survey data provide encouraging evidence that the eurozone will pull out of its double-dip recession in the second quarter. A manufacturing boom, fueled by surging demand both in domestic and export markets as many economies emerge from lockdowns, is being accompanied by signs that the service sector has now also returned to growth.

"Barring any further wave of infections from new variants, Covid restrictions should ease further in the coming months, driving a strengthening of service sector business activity which should gain momentum as we go through the summer.

"The intensity of the rebound will naturally depend on the extent to which Covid restrictions can be removed - and some measures relating to international travel are likely to remain in place for some time to come - but experience in other countries hints that the bounce in domestic activity could be strong as pent up demand and savings power a surge in spending.

"While the revival in the economy is bringing a rise in inflationary pressures, these so far seem largely confined to the manufacturing sector, with service sector costs - which form a major component of the core inflation measures tracked by the ECB - remaining only modest."