Latest data released by Markit - 23 April 2020

- Prior 26.4

- Manufacturing PMI 33.6 vs 38.0 expected

- Prior 44.5

- Composite PMI 13.5 vs 25.0 expected

- Prior 29.7

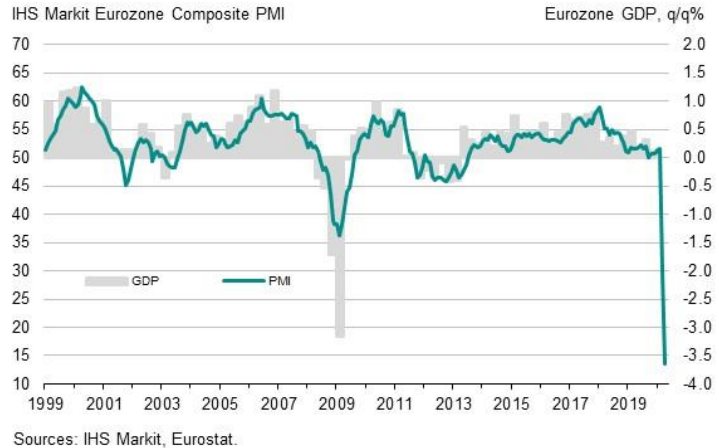

The poor readings here have been forewarned by the dismal French and German releases earlier, as we see an unprecedented collapse in the Eurozone economy.

The services and composite prints are at series lows while the manufacturing print sits at a 134-month low, though manufacturing output crumbled to its lowest on record.

Again, this is all largely due to the virus outbreak situation and lockdown measures causing businesses to close - resulting in a collapse in demand and supply.

Markit notes that:

"The extent to which the PMI survey has shown business to have collapsed across the eurozone greatly exceeds anything ever seen before in over 20 years of data collection. The ferocity of the slump has also surpassed that thought imaginable by most economists, the headline index falling far below consensus estimates."Our model which compares the PMI with GDP suggests that the April survey is indicative of the eurozone economy contracting at a quarterly rate of approximately 7.5%."With large swathes of the economy likely to remain locked down to contain the spread of COVID-19 in coming weeks, the second quarter looks set to record the fiercest downturn the region has seen in News Release Confidential ' Copyright © 2020 IHS Markit Ltd Page 3 of 4 recent history."Hopes are pinned on containment measures being slowly lifted to help ease the paralysis that businesses have reported in April. However, progress looks set to be painfully slow to prevent a second wave of infections. In the face of such a prolonged slump in demand, job losses could intensify from the current record pace and new fears will be raised as to the economic cost of containing the virus."