US GDP fell the most since the depths of the recession in Q1 2009. It’s also the largest revisions to the third reading on GDP since records began in 1976.

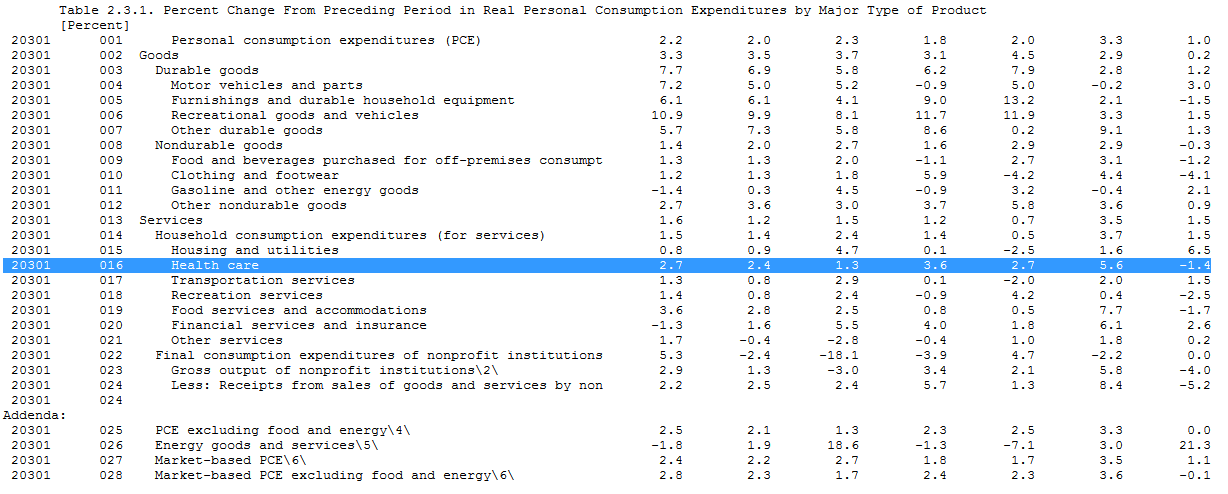

A large part of the revision was due to healthcare spending. Consumer purchases rose at a 1% annualized pace, which was much slower than the previous estimate of 3.1%. The story is that spending on healthcare due to Obamacare was expected to rise and a 1 percentage point to GDP. Instead, health care spending dropped and that cup 0.16 pp from GDP. In total, that’s a 1.3 percentage point revision.

The first estimate on healthcare spending was +9.9%

Inventories were also a drag, growing $45.9B compared to $49B previously estimated, subtracting 1.7 percentage points from GDP. Exports also took 0.4 pp off growth.

There was some good news in investment, which fell at a 1.2% annualized pace compared to 1.6% previously reported.

GDP annualized

The market is taken aback by the bad headline but inventories will reverse and lower spending on healthcare will translate into better spending elsewhere. Eventually the market will focus on the future rather than what happened 3-6 months ago and the US dollar will rebound.