Forex news for December 16, 2014:

- USD/RUB up 5.4%, rises as high as 79.16

- December 2014 US Markit manufacturing PMI flash 53.7 vs 55.2 exp

- Canadian Oct manufacturing sales -0.6% vs -0.3% expected

- November 2014 US housing starts 1.028m vs 1.040m exp m/m

- Fonterra price index rises 2.4%, volumes plunge

- Russia not planning capital controls – Ministry of Finance

- ECB’s Coeure says eurozone is not falling back into crisis

- Retail brokers curb ruble trading

- Italy non-performing loans at highest since June 1998

- Kuwait oil minister says OPEC countries in agreement on not having a meeting until June

- Hilsenrath: I think the Fed will look past trouble elsewhere, ‘strong possibility’ will drop ‘considerable time’

- US 10-year yields down 6 bps to 2.06% — low of 2.00%

- Gold up $1 to $1194

- WTI crude up 2-cents at $55.96 — range of $53.60 to $57.15

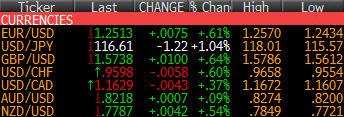

- GBP leads, AUD lags

Volatility was the story of the day in just about every asset class. The final chapter was risk aversion with the S&P 500 closing on the lows, down 16 points to 1979. At midday the market ripped up to 2017 in a relief rally as oil briefly jumped $3.

The ruble was the major story as it continued to collapse despite the massive hike in Russian interest rates. USD/RUB jumped as much as 23% as a panic set in. That spilled over to risk trades and knocked USD/JPY down to 115.57 — just above the 38.2% retracement.

EUR/USD seems to be benefiting from outflows from Russia. As the fears peaked, EUR/USD climbed to 1.2569, up about a cent on the day. As Russia began to stabilize it sagged back down to 1.2480 but some bidders have stepped in there twice to form a minor double bottom and a bounce to 1.2515.

Similar story in the UK, which has long been the port of choice for Russian money. UK CPI numbers were soft today and that sparked an initial drop in cable down to 1.5612 but it turned around in a big way and ripped to 1.5784 with the peak coming at the start of US trading. Most of the session was spent consolidating in the 1.5725 to 1.5760 range.

The Canadian dollar weathered the oil drop and pop well, likely due to the Talisman deal. The pair slipped down 1.1607 then bounced to 1.1640.

The Aussie didn’t far as well. After a pop to 0.8275 in Europe it faded to 0.8210 in US trading and remains within striking distance of fresh cycle lows.

Overall, it’s a very dangerous market that’s trying to tell the Fed to be careful. Will Yellen listen?

FX ticker