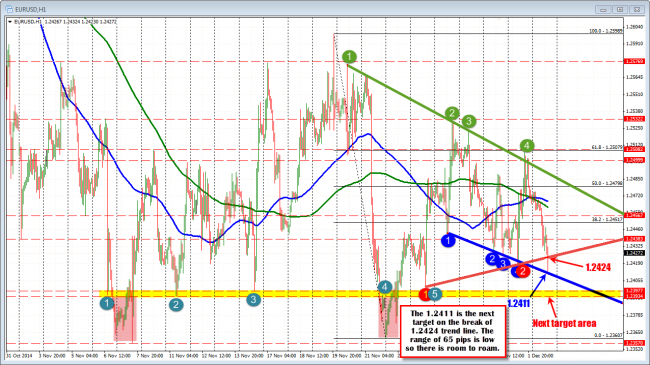

The EURUSD is lower on the day – making the high in the Asian session. The pairs fall from the day’s high, moved back below the 100 and 200 hour MAs (blue and green lines in the chart below) after spending most of the NY session yesterday above these key MA levels. When the high yesterday could not get above the 1.25000-1.2508 area (See: Forex Technical Trading: EURUSD shows some bullish signs but with good resistance ahead), that spelled trouble for the bulls.

EURUSD tests lower trend line at 1.2411

Currently, the price is testing the lower trend line at the 1.2411. This trend line held the line in trading yesterday and bounced. This a key intraday level for the pair again today.

Do we have room to roam lower?. We do as the range is narrow at 65 pips vs. an average of 103 pips over the last 22 trading days (about a month).

However, I am not surprise to see that there are buyers against the level now. What worked other times in the past (buying against the level) becomes a habit – especially in the non-trending up and down market we are in. Having said that, look for sellers against the 1.2424 level now (see chart above). If that can topside resistance can hold (and I think it should), it should be enough to push the pair lower and through the support trend line. The next target is the 1.2393.977 level.