Forex news for January 23, 2015:

- ECB’s Coeure: If QE impact isn’t enough “we’ll have to do more”

- November 2014 Canadian retail sales +0.4% vs -0.2% exp m/m

- Dec Canadian core CPI +2.2% vs +2.3% y/y expected

- January 2015 US Markit manufacturing PMI flash 53.7 vs 54.0 exp

- December 2014 Us existing home sales 5.04m vs 5.06m exp

- US Dec leading indicators +0.5% vs +0.4% exp

- Weidmann says QE package cuts reform incentive in France and Italy

- It’s right to look through oil impact on CPI says Carney

- Carney sees modest, limited, gradual rate rises over the course of the next 3 years

- Greece’s Tsipras says the Greek people are at a crucial juncture

- US’s Lew says strong dollar is good for America

- BOJ’s Kuroda says there are no technical limits on monetary policy

- SNB could enact new measures to help stem the rise in the CHF

- Syriza takes a commanding lead in latest polls

- Baker Hughes US rig count 1633 vs 1676 prior

- pro-Russia militants reject a Ukraine peace deal and launch offensive

- CFTC Commitments of Traders: Yen shorts lighten up, euro shorts pile in

- Saxo Bank loses up to $107m on Swiss franc trades – is chasing negative balances

- FXCM considers exiting some countries, is seeking negative balances

- Gold down $11 to $1294

- S&P 500 down 11 points to 2052

- WTI crude down $1.02 to $45.29

- JPY leads, EUR lags

The euro was the big loser once again on Friday but most of the damage was done before US traders got in on the action. The final run on stops came just after 7 am ET (noon GMT) and collapsed to 1.1115 but rebounded 60 pips almost immediately. From there it was a steady climb to 1.1289. The dovish headlines from Coeure only caused a 15 pip drop and it climbed higher afterwards. After London shut down some sellers returned in a slow grind to 1.1204.

USD/JPY was caught with the whims of the stock market but the big story was how easily it gave up yesterday’s gains in a slide as low as 117.55. Headlines didn’t have much of an impact.

The only headlines that sparked trading were from Canada on the retail sales report. The strong numbers sank USD/CAD by 70 pips down to 1.2380 in a lightning-fast move. But the dip buyers were waiting and it climbed all the way to 1.2430. Expect those dip buyers to continue buying.

WTI strangely rallied on the Saudi king’s death even though his replacement is more hawkish on supply. The market eventually figured it out and crude’s weekly close was the lowest since 2009. I shared my thoughts on where it’s heading next.

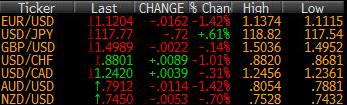

FX ticker

Have a great weekend!