Forex news for Asia trading for Thursday 14 January 2021

- 4 Federal Reserve speakers coming up on Thursday 14 January - including Chair Powell

- Bond sell-off hit gold, now hitting FX (USD higher) - follows talk of $2ln Biden rescue plan

- Lose the bid in gold ... Biden $2tln stimulus report impacting

- Biden's aid plan may be about $2tln, up $700bn from the $1.3tn Schumer asked for 6 hours ago

- China December trade data, CNY terms: Exports +10.9% y/y (vs. expected +7.1%) & Imports -0.2% y/y (vs. +0.1%)

- China has published whole of 2020 trade data, exports (yuan denominated) +4% y/y

- China has had its biggest daily jump in COVID cases in more than 10 months

- Japan economy minister Nishimura says the COVID-19 state of emergency could be extended

- PBOC sets USD/ CNY reference rate for today at 6.4746 (vs. yesterday at 6.4605)

- FX option expiries for Thursday 14 January at the 10am NY cut

- Bank of Japan Governor Kuroda says Japan's economy is picking up, but still in severe state

- Trump bans Americans from holding securities of blacklisted Chinese firms from November 11th 2021

- Reports that the Trump administration has shelved its planned investment ban on Alibaba, Tencent, Baidu

- There has been another wave of national security arrests in Hong Kong on Thursday morning

- UK will require international arrivals to provide proof of a negative COVID-19 test before departure to England

- UK data: RICS monthly house price balance for December +65 (expected 61%)

- Japan PPI for December -2.0% y/y (expected 0.2%)

- Japan Core Machinery Orders for November +1.5% m/m (expected -6.5%)

- Here is who gets a vote on the Federal Open Market Committee in 2021

- US President-elect Biden will speak Thursday 14 January 2021 at 7.15pm US ET

- Here is how the European Central Bank will cap the rising euro

- Fed's Rosengren expects significant near-term US economic weakness (but there are positive longer run tailwinds)

- Forexlive America FX wrap: House impeaches Pres. Trump for 2nd time

- Schumer says Trump could be barred from running again

- New Zealand Building Permits for November +1.2% (4th consecutive month of gains)

- Trade ideas thread - Thursday 14 January 2021

- More from Fed's Clarida

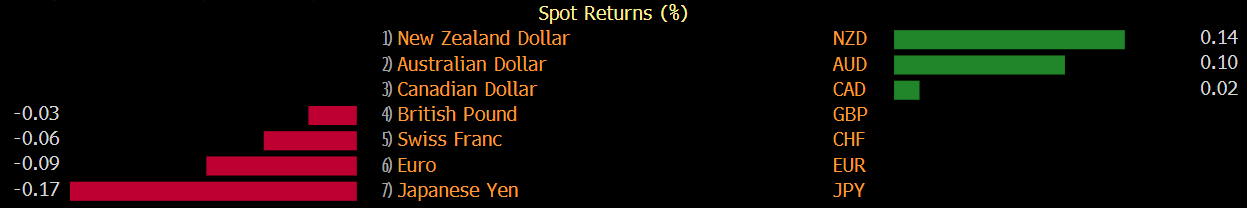

There were sharp moves in Asia today on the news that new (soon to be) President Biden's stimulus plan could be in the order of $US2tln, whereas as previous expectations had it pegged around $1.3tln. aud/usd ticked just a few points higher as the news hit but the pattern has been for rising yields on optimism over relief to boost the USD and that response soon prevailed. Gold was heavily hit, down from around $1850 to lows circa 1830. A few moments later FX followed suit, dropping pretty much across the board against the USD on the bonds sell-off.

As I post there has been some retracement of the USD moves, NZD and AUD showing some resilience.

In China, the PBOC again set the onshore yuan weaker than expected today, not by as much as on Wednesday but enough to raise the suspicion that the Bank is now more actively pushing back against yuan strength.

In US politics the House voted to impeach Trump once again. There will now be a trial in the Senate at a start date yet to be confirmed.