Forex news for Asia trading on Wednesday 14 July 2021

- Another province in China bans crypto mining

- NZD/USD higher after the RBNZ tilts more hawkish than was expected

- RBNZ policy decision minutes: 'least regrets' decision is reducing some support sooner

- RBNZ policy announcement - says level of stimulus to be reduced

- Sydney coronavirus outbreak spreads to Melbourne, 7 new cases

- More on Singapore Q2 GDP data released earlier - policy to remain unchanged

- PBOC sets USD/ CNY mid-point today at 6.4806 (vs. yesterday at 6.4757)

- US Senate Dem Budget Committee have agreed a $3.5tln deal

- Coronavirus - Sydney to get a 2-week lockdown extension (at least) - announcement incoming

- ARK's Cathie Wood sees deflation ahead, bond bubble, says don't be long oil

- Oil - OPEC Saudis & UAE rift - but even bigger cracks within the organization loom

- Australia data - Westpac Consumer Confidence Index (July) +1.5% m/m (vs. prior -5.2%)

- ICYMI - UK police have seized US$400m of cryptocurrency

- Singapore preliminary Q2 GDP -2.0% q/q (expected -1.8%)

- NAB says the RBNZ will need to acknowledge the strength of domestic NZ economic data - undeniable

- More on the interest rate rises in New Zealand

- Reuters Tankan report for July, manufacturers sentiment improved, services drop

- New Zealand reported a huge y/y % increase in visitors in May - due to travel bubble coming into play

- SCMP - China should increase fiscal spending to further support its economy

- ICYMI - IEA says oil markets are set to tighten significantly unless OPEC standoff resolved

- New Zealand - ASB raises mortgage rates (comes prior to the RBNZ policy announcement today)

- US, UK trade ministers met, agree to collaborate in addressing "anti-competitive practices of China"

- More on Fed's Bullard belief that the time is right to pull back on stimulus

- Trade ideas thread - Wednesday 14 July 2021

- Private oil survey data shows a draw in headline crude oil inventory

- Fitch has affirmed the US rating at 'AAA' with a negative outlook

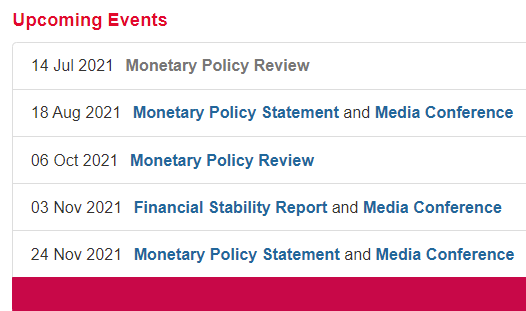

The Reserve Bank of New Zealand 'minor' policy review today resulted in the Bank announcing an end date to additional purchases for their QE program, the Long Term Asset Purchasing (LSAP) scheme. When I say 'announced an end date', its at the end of next week! The program will finish on July 23. This is a more hawkish outcome than was expected from the meeting, expectations had centred on a change in language from the Bank to less dovish. Well, we got that, and a significant slice of more.

NZD/USD had been inching a little stronger into the meeting, not by much but noticeable, and upon the Bank's announcement, it jumped 30 points or so and has since extended its gain to highs circa 0.7020.

Last week we had strong economic data from New Zealand (you'll recall the QSBO) that triggered a cascade of rate hike forecasts being moved to November of this year (from around August of 2022); all four of New Zealand's largest four banks with that projection. After today's RBNZ market pricing for that Nov. Hike is now fully priced in.

Note that there are plenty of meetings between now and November though, market pricing is indicating each and every one of them is now 'live' to some extent, August is a 50/50 probability according to OIS (ASB have changed their forecast from November to a hike in August).

News elsewhere was non-impactful. The coronavirus situation in Australia's largest capital has resulted in a 2 week lockdown extension for the city (ps. that'll be 'at least' another two weeks IMO). Note that Sydney's lockdown is fairly soft and may need tightening ahead to combat the spread. Speaking of spread, neighbouring southerly state of Victoria has reported 7 new cases today linked to the outbreak in Sydney/NSW.