Forex news for Asia trading for Tuesday 29 December 2020

- Update on US COVID $2000 relief checks - passed by the House, Senate meets on Tuesday

- PBOC sets USD/ CNY reference rate for today at 6.5451 (vs. Monday at 6.5236)

- FX option expiries, Tuesday 29 December 2020 at the 10am NY cut

- US House has easily passed the COVID $2000 check bill, as promised

- Trade ideas thread - Tuesday 29 December 2020

- US $600 checks will begin to be sent this week

The Lower House of the US Congress passed the bill to provide COVID-19 relief checks to Americans of $2,000. Last week Trump called the $600 checks a 'disgrace' and called for a boost to $2,000 and the Democrat-controlled House of Representatives have delivered.

The bill now heads to the Upper House, the Senate, which convenes on Tuesday US time. So far Leader of the Senate McConnell has not indicated he will bring the bill on for a vote. Democrat Senators have expressed support for the bill, Senator Sanders says he will take measures to stop the chamber from adjourning for the New Year's holiday break until a vote on the bill is allowed. Current indications are however that Republicans in the Senate do not support the increased amount. While the bill seems doomed to fail in the Senate nothing is certain at this stage. Tune in on Tuesday for how this plays out.

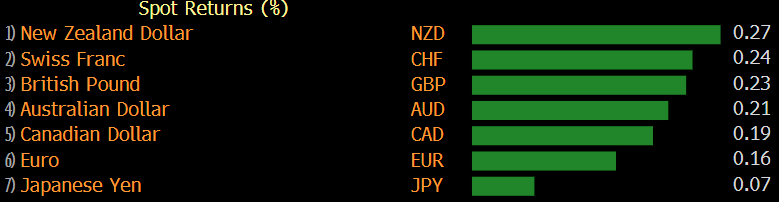

FX markets seem to have responded with optimism, the USD is a little lower pretty much across the board; EUR, AUD, NZD, CAD, CHF, GBP are all up against the dollar while yen is a bit of a laggard. Equities, too, have been bid, US equity index futures overnight trade has once again tracked higher. Gold is up small.

There was little other news and no data at all relevant to the majors.

Regional markets:

- Nikkei +1.63% (to its highest since August 1990)

- Hang Seng +0.87%

- Shanghai +0.08%