Forex news for Asian-Pacific traders for December 8, 2017.

- China's booming exports a potential flag of upside risk to growth in 2018

- EU commission: May and Juncker likely to meet at 0600 GMT in Brussels

- Five things to look out for in today's US jobs report

- Bitcoin technical analysis. Bitcoin tests intraday 200 bar MA

- Forex technical analysis: AUDUSD sees a little upside move after China data

- China November trade balance +$40.2 bn vs +$35.0 bn expected

- How Bitcoin futures trading may look like

- China trade balance +263.6B yuan vs est 240.8B

- Japan's Nikkei is having another big day. Up 1.2% at the morning close

- Bitcoin moves above $17K

- PBoC sets Yuan mid point at 6.6218/Dlr vs last close 6.6140.

- Australian Home loans for October -0.6% vs -2.0% estimate

- Japan's October real cash earnings rise 0.2% versus 0.2% estimate

- Japan Bank lending including trusts YoY 2.7% vs. 2.8% estimate

- Japan BoP current account adjusted for October Y 2176.4B vs.Y1932.7B

- Japan GDP 3Q (final) QoQ 0.6% vs. 0.4% estimate

- Its official... US Senate votes to pass the stopgap bill to avert shutdown

- Interactive Brokers CEO Peterffy give Bitcoin 5 years life expectancy

- Theresa May close to Brexit agreement with EU as DUP weigh up the deal

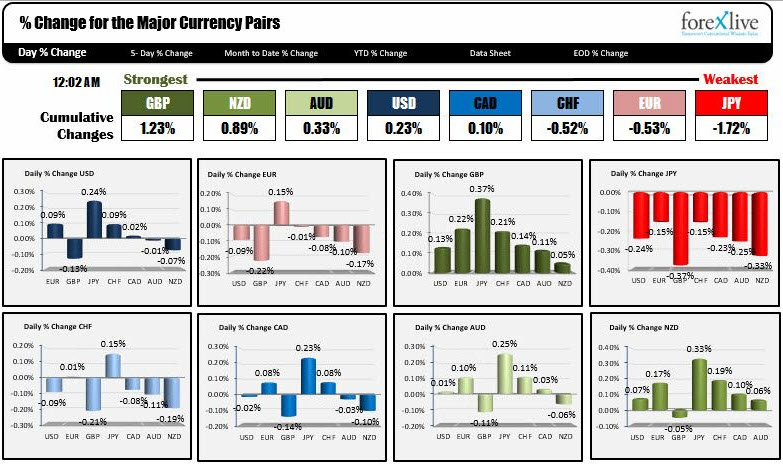

- The snapshot of the winners and losers at the end of day.

- New Zealand manufacturing sales SA 0.5% vs 3.9%

- Goldman plans to clear bitcoin futures for "some" clients

- ForexLive Americas FX news wrap: Bitcoin mania goes manic

A snapshot of other markets shows:

- Spot gold up $1.22 or 0.10% at $1248.50

- WTI crude oil futures are down three cents or -0.4% at $56.66

- Asian stocks are higher today: Japan's Nikkei 225 up 1.18%. China's Shanghai index is higher by 0.21%. Hong Kong's Hang Seng index is up 0.87%. Australia's S&P/ASX index is up 0.27%

- US yields are little changed in quiet trade. The two-year yield is at 1.806%, up 0.4 basis points. The 10 year yield is at 2.3688%, up 0.5 basis points.

The big news for the day will not happen until the US releases their employment report at 8:30 AM ET/1330 GMT. The expectation is for Non-Farm Payroll is expected to rise by 195K vs 261K last month and the unemployment rate is expected to remain unchanged at a low 4.1%.

As a result of the anticipation, the price action was somewhat muted in the Asian Pacific session.

Nevertheless, there was some decent data out of Japan and China.

Japan released the final for 3Q GDP and it was higher than expected at 0.6% vs. 0.4%. The annualized reading was also much better at 2.5% vs 1.5% expectations. The not so good news from the report was the consumer remains sidelined with private consumption down -0.5% and the deflator remains low at 0.1% (see details of the report here). Despite the better growth number, the JPY weakened. In fact it was the weakest of the major currencies in trading today with declines against each of the majors (see chart below)

China reported good trade numbers with both exports and imports showing double digit gains (exports up 10.3% and imports up 15.6%). The better data did sort of help the AUD and NZD try to pick itself off lows. However, I cannot say the bearishness is totally complete for those currencies.

For the NZDUSD, the pair did hold support at the 0.68159-19 area (the low stalled at 0.6821), and the pair is at 0.68345 currently. However, the high did stall at the 0.6840 level. We need to see more buying above that level going forward to solicit more buyers.

For the AUDUSD, the pair reached a low right above the natural support level of 0.7500 (low reached 0.7501) but could only get to 0.7516 on the rebound. That level corresponded with the 200 bar MA on the 5- minute chart. The price could not get above the 200 bar MA all day yesterday. Not being able to get above it so far today is not encouraging for the dip buyers.

In other market developments:

- What would be a day be without another new big figure handle change in bitcoin. The $17,000 level was broken in the Asian Pacific session (high reached $17,027.39). However, as I type, the price is trading at the lows for the day at $15,110. Moreover, the price has cracked below the 200 bar MA on the 5-minute chart (see chart below). That MA found early buyers yesterday, and buyers on the first test today. Staying below going forward, will be more bearish for the cryptocurrency.

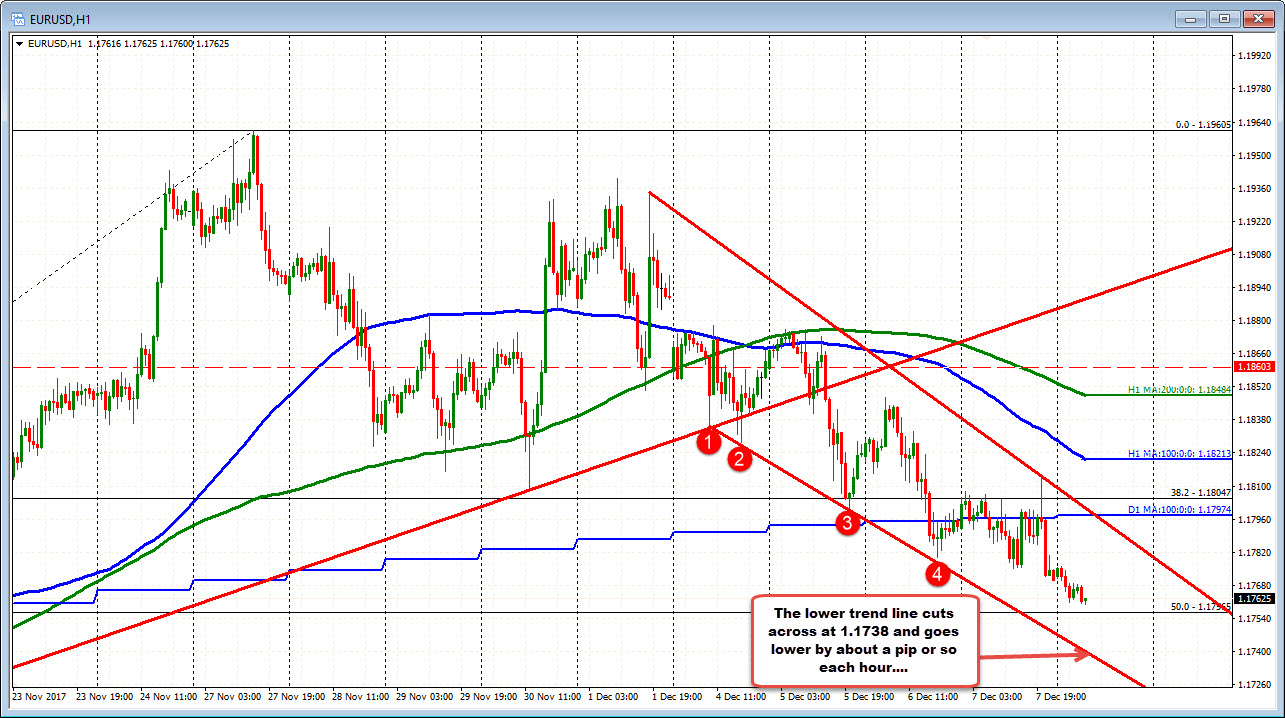

- Technically, the EURUSD fell further away (to the downside) from the 100 day MA after trading most of yesterday above and below the MA level. That 100 day MA is at 1.1797 (call it 1.1800), and through the employment report that MA will act as a key risk level for sellers/bears in the pair. Stay below is more bearish. The current price is trading at 1.1760. On the downside, the pair is approaching the 50% retracement of the move up from the November low at 1.17565. A lower trend line on the hourly chart below cuts across at 1.1738 (and moving lower by a pip or so an hour). The 1.1711 was the August 2015 swing high (that old chestnut).

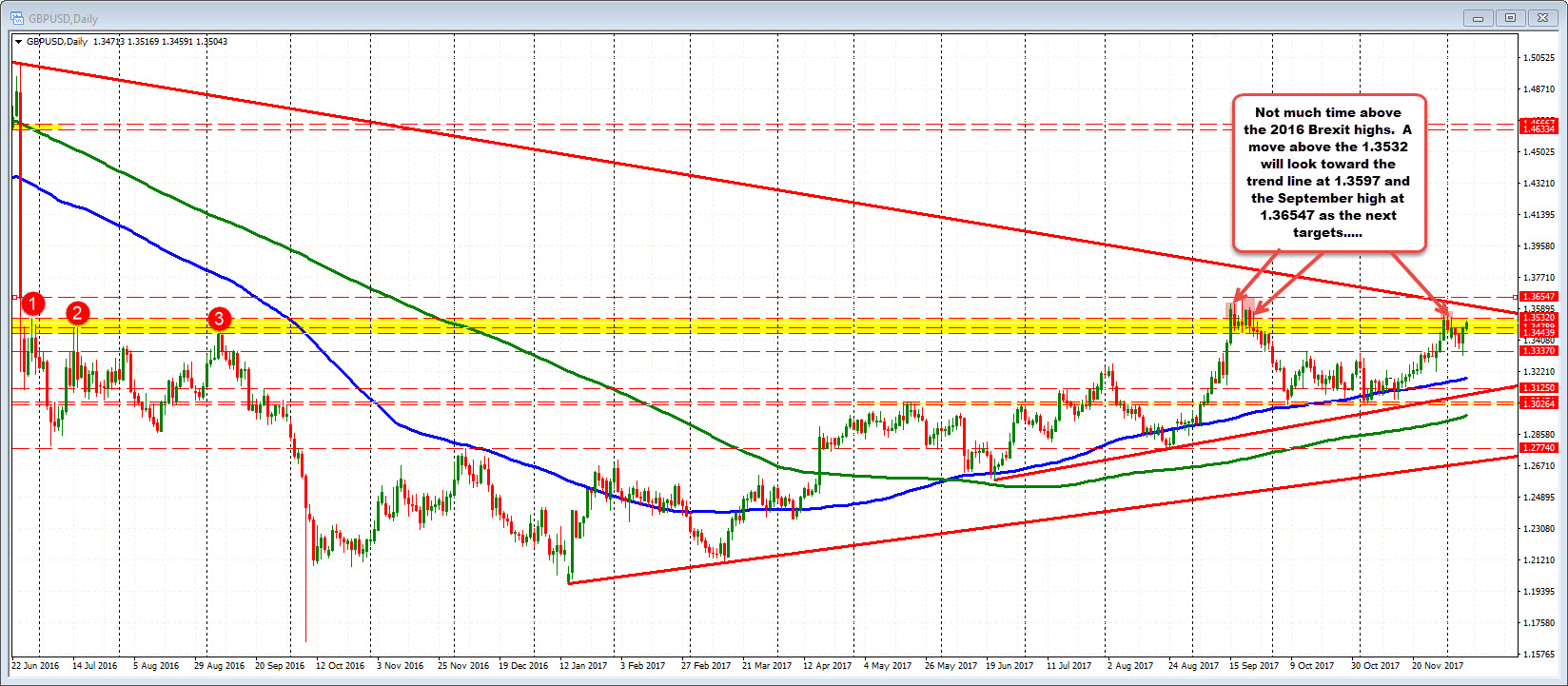

- UK PM Theresa May is heading to Brussels to present a solution for Ireland and the divorce settlement. If accepted, it paves the way for the next steps in the Brexit negotiations. That has the GBPUSD moving higher. The pair is getting close to the post-Brexit high from June 2016 at 1.3532. The price has moved above that level at the end of November and the beginning of December, without much momentum. A move above would be more bullish with a trend line at 1.3597 and the September high at 1.36547 the next targets.

Thank you for your patience with me in Eamonn's absence. Wishing those trading the US employment good fortune with your trading. For all others, wishing you and yours a fun and safe weekend.