Forex and cryptocurrency news from the European trading session - 12 April

News:

- Trump says an attack on Syria could take place "very soon, or not so soon at all!"

- Kremlin say it's extremely important not to raise tensions in Syria

- WTO says 2017 world trade volume grew 4.7% vs 3.6% September forecast

- The market is gearing up for a Fed hike in June

- More from Davis: UK has made no decision on government response to Syria

- UK lenders report large Q1 drop in availability of unsecured loans to consumers

- UK's Davis says "virtually nothing" will change for businesses during Brexit transition period

- Altcoins face strong pullback on the day

- European Council extends Iran sanctions by one year

- BOJ Nagoya branch manager says firms are voicing worry over US trade policy uncertainty

- EUR/USD closes in on key near-term support levels as the dollar takes charge on the day

- German economy ministry says economic upswing continues but at slightly weaker pace

- AUD/NZD inches closer to multi-year support level

- China to keep prudent and neutral monetary policy - state council

- Kiwi back on the move again, NZD/USD to session highs

- Citigroup's bold call on European stocks

- European equities start the day with a cautious tone

- Trading ideas for the European session 12 April

- BOJ's Etoh: No big impact on Kansai economy from US-China trade spat

- BOE's Broadbent doesn't comment on monetary policy

- Barclays says that geopolitics is to keep Brent price over $70 in April - May

- BlackRock doesn't see China weakening the yuan

- Nikkei 225 closes lower by 0.12% at 21,660.28

- UAE energy minister says idea of long-term alliance liked by majority of participating countries

- The US' high borrowing costs are just about to get higher

- BOJ Sakura report: Keeps assessment for 6 of 9 regions

- Geopolitical risks weigh on Asian equities today

- Forecasts by Japanese strategists, investors for the Nikkei 225 this year

- Heads up on BOE speakers later today

- The US yield curve continues to flatten amid geopolitical and trade tensions

- Oil extends gains on the day as key resistance levels give way

- World Bank raises China 2018 growth forecast to 6.5% from 6.4%

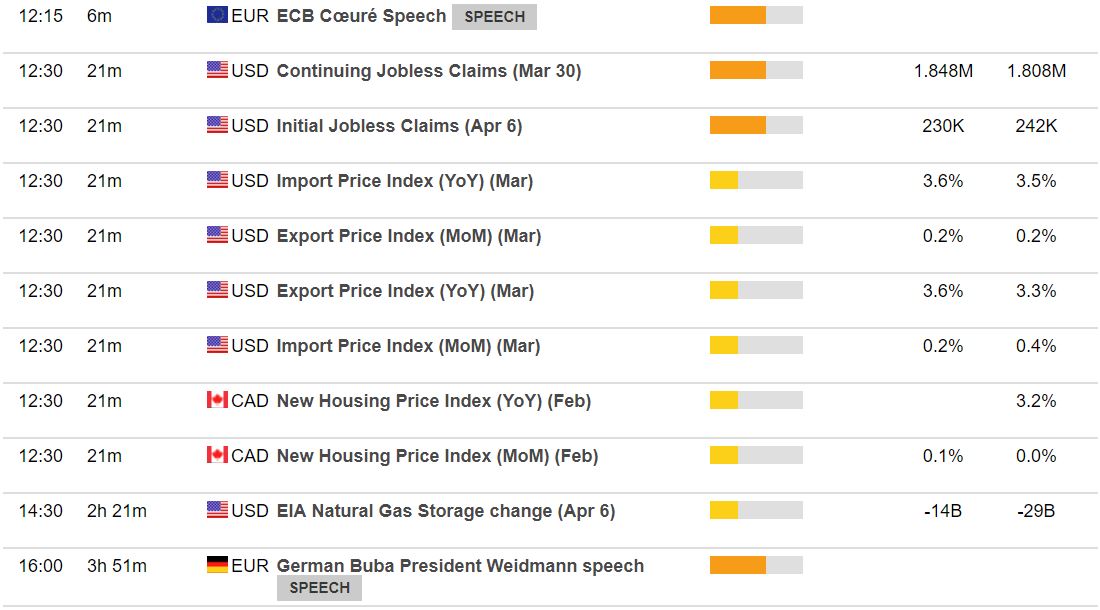

Data:

- Eurozone February industrial production m/m -0.8% vs +0.1% expected

- France March final CPI m/m +1.0% vs +1.0% prelim

Fun and games again as fluctuating risk sentiment over Syria creates some good volatility.

Early risk off sentiment saw JPY demand again which sent core pairs lower too with USDJPY dipping into 106.80 support. GBPJPY supply down to 151.17 saw GBPUSD lows of 1.4145 while EURJPY lows of 131.80 brought EURUSD down to 1.2330

USDCHF underpinned again though with SNB the obvious candidate pre-empting Syrian-based safe-haven CHF demand and we've seen 0.9637 from 0.9590 with EURCHF also rallying.

USDCAD has found itself also on a whippy ride between 1.2580-1.2620 while NZDUSD continues to enjoy safe-haven demand and AUDUSD has large option expiry interest keeping range contained between 0.7740-60 for the most part.

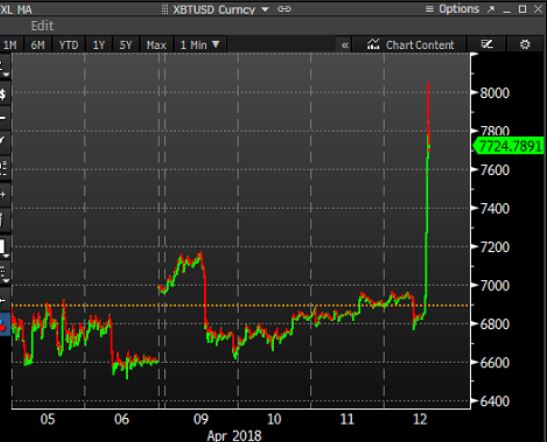

Bitcoin took off as risk-on sentiment returned and has soared to test $8000 before falling back to $7800 as I type.

Data and CB talking heads coming up: