Forex news from the European trading session - 9 August 2018

Headlines:

- EU said to offer a major Brexit concession to UK PM May

- Signs of disharmony in China over US trade dispute?

- ECB says downside risks to the global economy have intensified

- Turkish lira continues to fall, reaches record low against the dollar

- RBNZ's McDermott says chances of a rate cut have increased

- Japan July preliminary machine tool orders +13.0% vs +11.4% y/y prior

- Switzerland July unemployment rate 2.4% vs 2.4% expected

- BOJ watchers now see less chance of future policy changes in 2019

Markets:

- GBP leads, NZD lags behind

- European equities mixed

- Gold up 0.08% to $1,214.93

- WTI flat at $66.94

- US 10-year yields flat at 2.958%

- Bitcoin up 0.45% to $6,345

The overall changes on the session has been rather modest, with exception to the kiwi which continues to lag behind the rest of the major bloc after the RBNZ shifted to a more dovish stance. Comments by the central bank's assistant governor and chief economist McDermott here did not help its case either.

The session played out with very little clear themes as currency pairs struggled for direction mostly. Cumulatively, the dollar is a little higher but those gains are hardly reflected when you look at individual currencies themselves.

The notable move on the session was the pound once again moving towards lows mid-way through with cable taking out yesterday's low and touched a bottom of 1.2842. The move reached the downwards trendline and bounced thereafter to around 1.2890.

Then, there was the headline from a report by Business Insider that the EU is set to offer Theresa May a major concession on Brexit. The report was released about an hour but was only picked up on the wires rather late, so that may have helped with the bid seen in sterling apart from technicals. But when the report did gather steam, cable "popped" above the 1.2900 level.

However, as mentioned in the same post, it's not likely that this proposal will fly domestically in the UK and that means that it's not likely to change much but at least there is some added likelihood of avoiding a no-deal Brexit outcome.

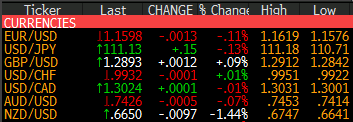

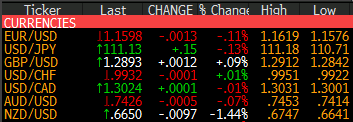

Looking at individual currencies, EUR/USD continues to play ping pong between the two key hourly moving averages. The pair traded to a low of 1.1576 before moving to stay around the 1.1590-00 levels for most of the session.

USD/JPY is another pair rather anchored around the 111.00-10 levels with large expiries keeping the pair in check for the time being.

USD/CAD remains in a tight range (30 pips) on the day after moving to a low of 1.3001 early in the session before recovering to near the highs currently as buyers came back in at the figure level to bid up the pair following yesterday's move lower after the NAFTA news.

AUD/USD is another pair that remained relatively subdued as it traded between the 0.7420-30 levels for majority of the session after having moved to a low of 0.7414 alongside a drop in the kiwi. NZD/USD remains near the lows as comments by RBNZ assistant governor continued to pile on the gloom factor. The pair tracked to a low of 0.6641 on the session and stays near there currently.