Forex news for NY trading on February 1, 2018 isas.

- US stock end a volatile day with mixed results

- USDCHF tests the swing low from August 2015

- The Australian dollar ... "may finally be set for a correction"

- Bitcoin loses more. Down to $8400 on Coinbase

- US January domestic vehicle sales 4.11m vs 4.30m expected

- US crude oil/brent crude ends with strong gains

- February seasonals: A red hot market that can get even hotter

- The drop from the high in Bitcoin is now the worst in three years

- Higher yields start to weigh on stocks. 30 year goes above 3%

- A long trend line was broken today in the AUDUSD, but seeing a bounce

- February forex seasonals: The gold rush continues

- Trump: Maybe there will be a 'phase 2' of tax reform

- Atlanta Fed GDPNow Q1 estimate jumps to 5.4% from 4.2%

- BOE's Brazier: BOE looking at market-based finance as next policymaking 'frontier'

- European stocks ending the session mostly lower. Stronger EUR hurts.

- ECB Nowotny: ECB should end bond buying program

- Bitcoin cracks below $9000. Stops being triggered

- Some ECB officials said to want clearer interest-rate guidance - report

- US construction spending for December 0.7% vs. 0.4% expected

- January US ISM manufacturing index 59.1 vs 58.6 expected

- US January final Markit manufacturing PMI 55.5 vs 55.5 expected

- Weak auto sales the story so far

- A glace at the latest Goldman Sachs foreign exchange forecasts

- US initial jobless claims 230K vs 235K estimate

- US Q4 preliminary nonfarm productivity -0.1% vs +0.7% expected

In other markets, a snapshot at the end of the day shows:

- Spot gold is up $4 or 0.3% at $1349.24

- WTI crude oil futures are up $1.35 or 2.09% at $66.08.

- Bitcoin is trading back at $9184 after tumbling to $8400

In the US stock market, the trading was volatile as earnings and expectations for earning after the close, led to sharp swings:

- The S&P index ended down -1.83 points or -0.06%

- The Nasdaq ended down -25.619 points or -0.35%

- The Dow rose 37.32 points or 0.14%

Yields surged today:

- 2 year 2.1569% up 1.6 basis points

- 5 year 2.5644%, up 5 basis points

- 10 year 2.782%, up 7.5 basis points

- 30 year 3.016%, up 8.0 basis points

It was a volatile day in the markets today.

US yields surged with the 30 year trading at the highest level since May 2017 and above 3%. It is ending the day up 8 basis points on the day. The 10 year yield is also up strongly, with the yield moving to 2.782% up 7.5 basis points.

Earlier in the day, the 4Q unit labor costs increase by a greater than expected 2.0%.

Also, claims were low at 230K. Remember, the Labor Department will release the US employment report tomorrow at 8:30 AM ET/1330 GMT.

ISM Manufacturing data was also better with prices paid at the highest level since 2011.

Finally, the Atlanta Fed came out with an eye raising guesstimate for Q1 GDP. Admittedly, it is early in the quarterly cycle, but they put the estimate at 5.4%. That's HUGE. If Trump gets wind of the number, he might be inclined to use that statistic in his stump speeches going forward.

Next week, the treasury will auction off 3s, 10s and 30 year issues in its quarterly auction. The auction supply was increased as a result of the trimming of QE by the Fed (they don't buy as much bonds). The US Treasury is testing the demand in the market with the increased supply out the yield curve. The back up in yields will make selling that paper easier.

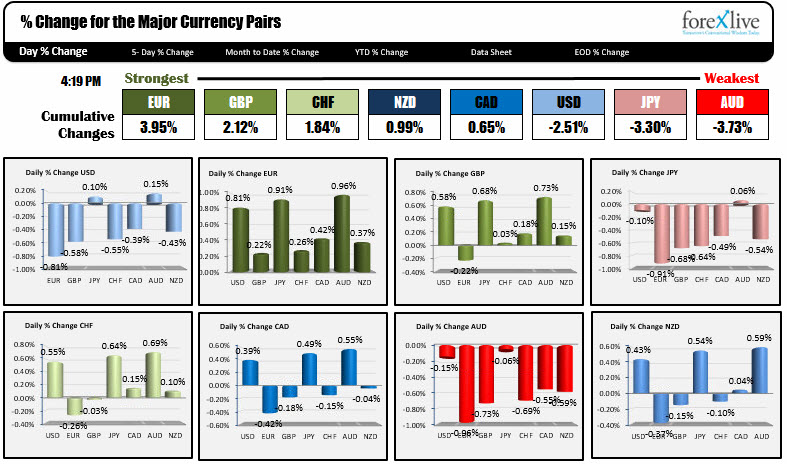

While the yields rose, the dollar is ending mostly lower. Looking the snapshot, below the dollars fall vs the EUR was the biggest mover. The greenback lost around 0.81% on what was a trend move higher. The favorite question is "Why?" The ECB has said QE would continue until at least September and rates would stay low well past that date. Meanwhile, the Fed has penciled in 3 (maybe 4) tightenings. There are three reasons for the rise.

- Technicals are bullish. The price today moved above a key upside trend line today. That line comes in at 1.2481 in the new day. Stay above keeps the control with the longs (the price also remained above the 200 hour MA at the lows today, and rocketed back above the 100 hour MA at 1.24167 currently).

- The EU is growing despite the higher EUR and still has lots of stimulus in the pipeline.

- The US is working toward more inflation, higher rates, and that will choke the stocks and the economy. The market is discounting that idea.

Who knows. What I do know, is the dollar remains more pressured and as long as the technicals remain bearish for the greenback, the buyers will continue to feel that squeeze feeling.

Finally, bitcoin got trashed down to $8400 on Coinbase today. In the process the price moved below the January 2018 low at $9005 (of course). However, the last few hours of trading saw the price rocket higher and it is trading around $9100. Wow!

PS. Amazon, Alphabet and Apple announced after the close (along with others) ending what was a chock-o-block couple days of earnings. In addition to those three gigantic bellweathers, Alibaba, Microsoft, Amgen, GoPro, Visa, AT&T, Boeing, PayPal, and Qualcomm.