A snippet from ANZ's latest look at commodities, this on gold:

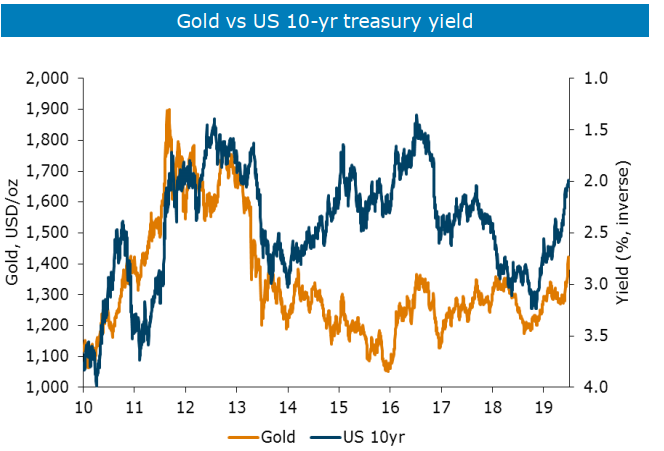

- Gold remains a valuable asset amid rising geopolitical tension, growing macro uncertainty and a maturing economic cycle. The market expects synchronous rate cuts globally, which will make non-yielding gold attractive for investors.

- Safe-haven buying of gold continued, with ETF holdings rising by 150t. The central bank buying spree continued in an effort to diversify from the US dollar. In PGMs, we see auto catalyst demand supportive, as the new China VI emission legislation kicks in from this month

---

the central bank buying spree ANZ refers to we have covered in past months on ForexLive. Its been notable indeed.