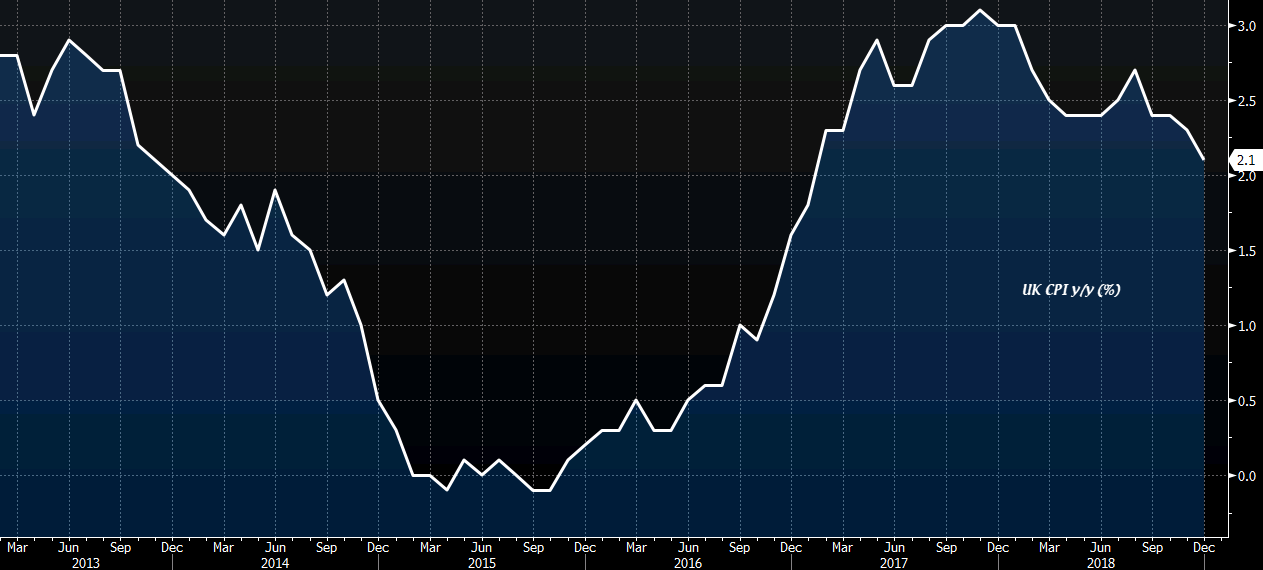

Headline inflation is expected to slow further once again

The headline reading is expected to decline to +1.9% y/y last month following the +2.1% y/y reading seen in December (as per the above). However, core inflation is expected to still hold steady at +1.9% y/y.

A fall below the 2% threshold for inflation readings would highlight less room to maneuver for the BOE with regards to rate hikes, so that could see the pound be pressured a little if the actual reading misses to the downside.

However, with the current focus still on Brexit, don't expect any material shift in terms of BOE pricing to come from just this report here (not like there is much to really price in/out in the first place) regardless of a miss/beat on expectations.

And even if the report comes in within expectations, I would expect headlines to focus on the drop in the headline reading and that could spur some minor selling in the pound. But similar to the BOE last week and the Q4 GDP on Monday, don't expect these events to have a lasting effect. It's all about Brexit, Brexit, Brexit.