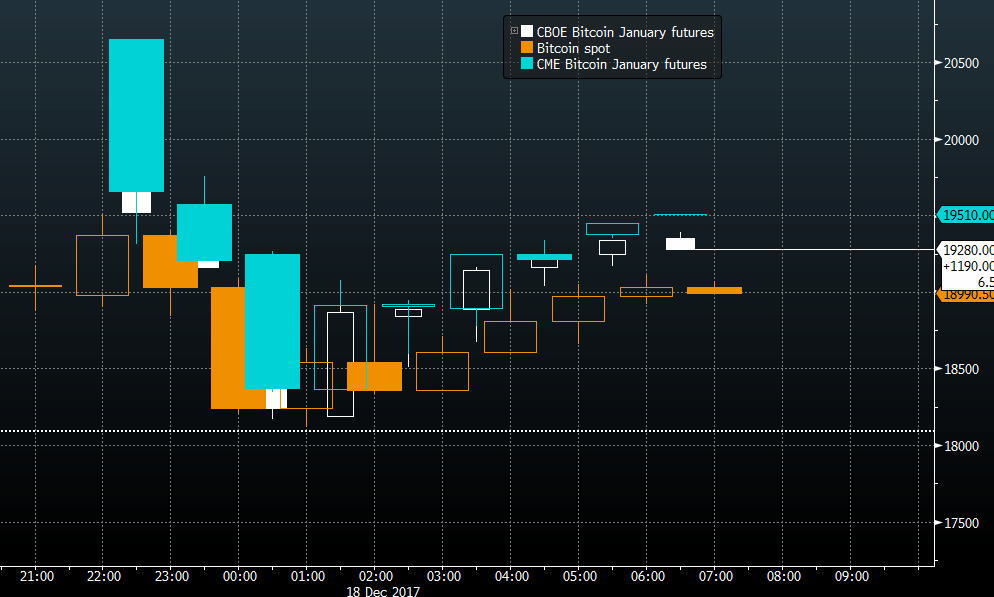

The CME launched Bitcoin futures trading today, and it is looking much better than the CBOE's launch last week

The one word to sum it up so far is 'efficient'.

The CME Bitcoin January futures track the actual price of Bitcoin much more closely than what the CBOE Bitcoin January futures did at the start of last week. The CBOE contracts at one point had a 13% price differential with the actual Bitcoin, but CME contracts are having none of that.

So far, we're seeing 637 contracts exchange hands on CME's debut day - but do keep in mind that each CME contract is tied to 5 Bitcoins, unlike the CBOE's 1-to-1 approach.