Watching and waiting, waiting and watching is what I do. Keeping a constant eye out for changes in the proverbial weather.

Watching, always watching

For a month or so I’ve been watching EZ data start to pick up and by and large the market has ignored it. We’ve had GDP up, PMI’s across the sectors up, industrial production up today, even retail sales have shot up. They are all starting to move in the right direction which is different to what was happening previously. When we hit the floor in growth there were pick ups in indicators but they soon fell back as it just wasn’t time yet, despite the clowns telling us otherwise. But it’s the natural order of things that nothing goes down forever and the Eurozone has put in a good run on that front.

I’ve said on many occasions that we need to watch for signs that a real recovery is coming and I’m beginning to think that now is that time. I could probably copy and paste everything I wrote about the start of the UK recovery we saw and it would be valid here too. Let me be clear though, I’m not forecasting boom times to come but something similar to the slow and steady turnaround that we saw in the UK, which is a good blueprint to use.

So aside from the pick up in data what else are we seeing? Bond yields are tumbling, which is good on so many fronts. The money coming into Europe and its bonds is a boost to the overall economic picture. The Euro is now both a safe haven, and decent yield returning region. Where else can you get 3-5% on government bonds with a central bank (and all it’s protective policies) like the ECB watching your back? The returns aren’t being eroded by inflation either. This is also leading to government debt costs falling meaning more money to waste put to better use elsewhere in the economy. It’s a snowball effect and one that when started tends to gather pace fairly rapidly as the positive effects roll into other parts of the economy. It’s those effects being sustained that I look for.

The moves to shore up banks and regulation is also quietly adding to a stronger picture of Europe. Yes we may moan and groan at all the talking heads and the length of time it takes to do anything and the arguments they have in getting things done, but get them done they will and from an outsiders point of view that means further security for your money.

Make no mistake though, there are some big pitfalls and hurdles to overcome as well. The shocking levels in unemployment, very weak inflation, a still weak European consumer and Europe’s ability to make the simplest of things complex. They are all things that will keep the shackles on the recovery, but not enough to derail it, though inflation is the biggest threat.

On that front I think we will see a bottom around here (0.5%-0.8%) in core inflation as the wheels slowly start to turn on the recovery. The biggest drag is unemployment and low wage growth. Until the population can start catching up on wages spending will remain weak. As long as jobs are in short supply and candidates aplenty companies have no reason to increase their costs by increasing wages. Remember, at the end of the day a company/business is there to make money not to lower unemployment. If the company does well then naturally it will start increasing workers and wages. Again, it’s a snowball effect.

So after all the blurb we come down to the nitty gritty and what that means trading wise. The stubbornness of the Euro is widely pointed out, and is due to several of the factors pointed out above. Is there room for a a rise in EUR/USD on a recovery? I think there is. The currency is a big talking point when it comes to Europe. Of course if it’s high it will affect business but as I mentioned in the comments yesterday (and in the case of the UK previously) Europe is more or less coming from a standing start. If your business isn’t doing any it doesn’t matter where the currency is at and that’s the big point. Business needs to pick up and that’s the first thing in the minds of owners, not where the currency is. They will happily wear some loss in margin on the back of the FX if it means there’s orders going out the door. At these economic levels it’s ‘worry about the business first then worry about the margins’. So the bank heads and politicians will jawbone on about the euro’s levels but they can’t really do anything about it, so it’s one reason why it won’t go down.

Much like the reason I switched from GBP/USD to EUR/GBP when I saw the UK recovery was that the US is a big horse to bet against and that should be a factor to bear on mind here also. That said the downside is always hard work in EUR/USD and even the US returning to decent growth levels may not see it much lower. I still like the tech around 1.33

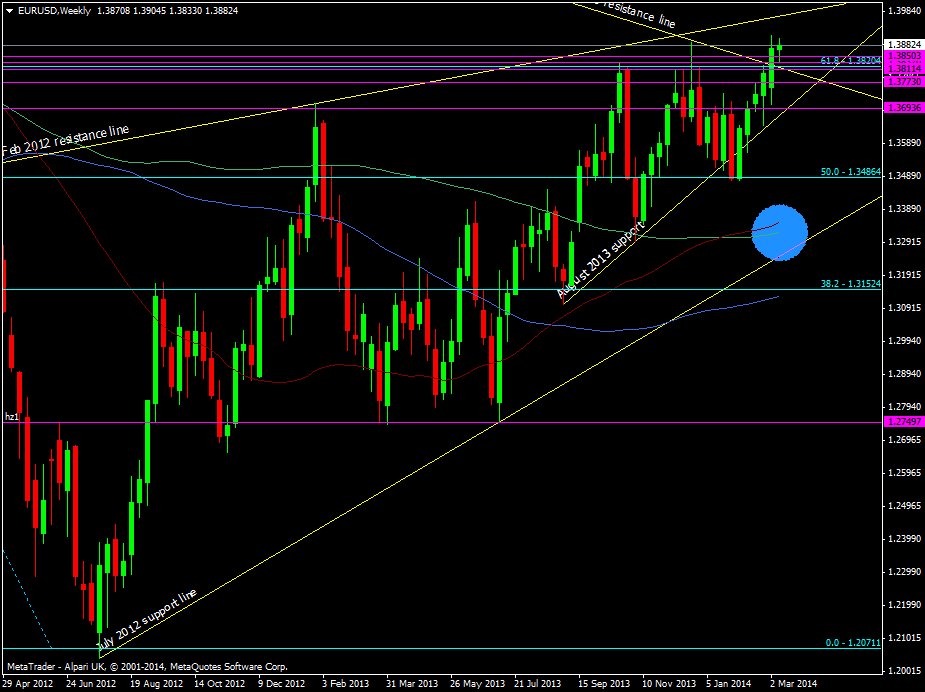

EUR/USD weekly chart 12 03 2014

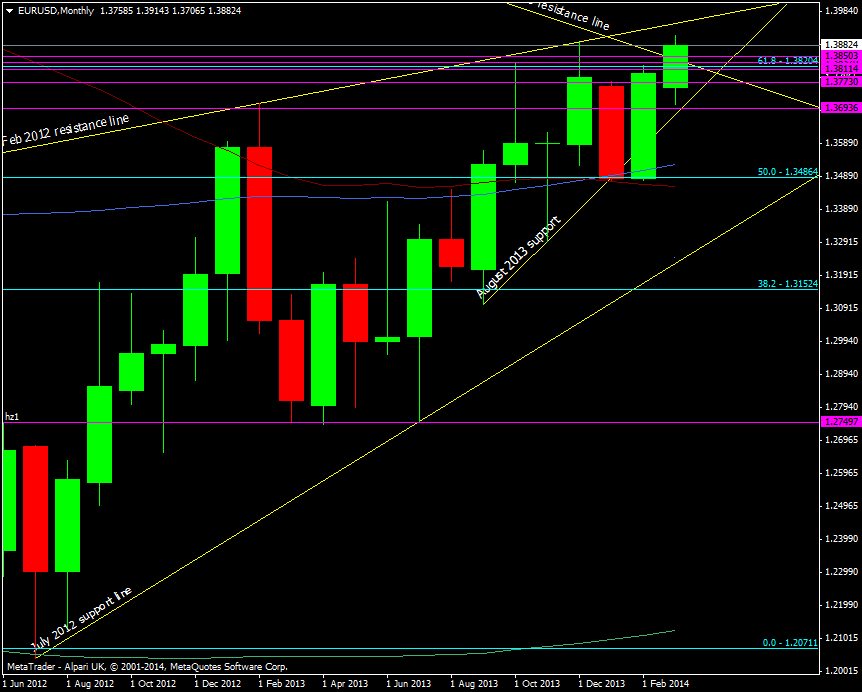

but that may be a bit too far to look for a move down. On the monthly chart the 100 and particularly the 55 mma around 1.3460/1.3527 seem a more reasonable expected target to scale in longs.

EUR/USD monthly chart 12 03 2014

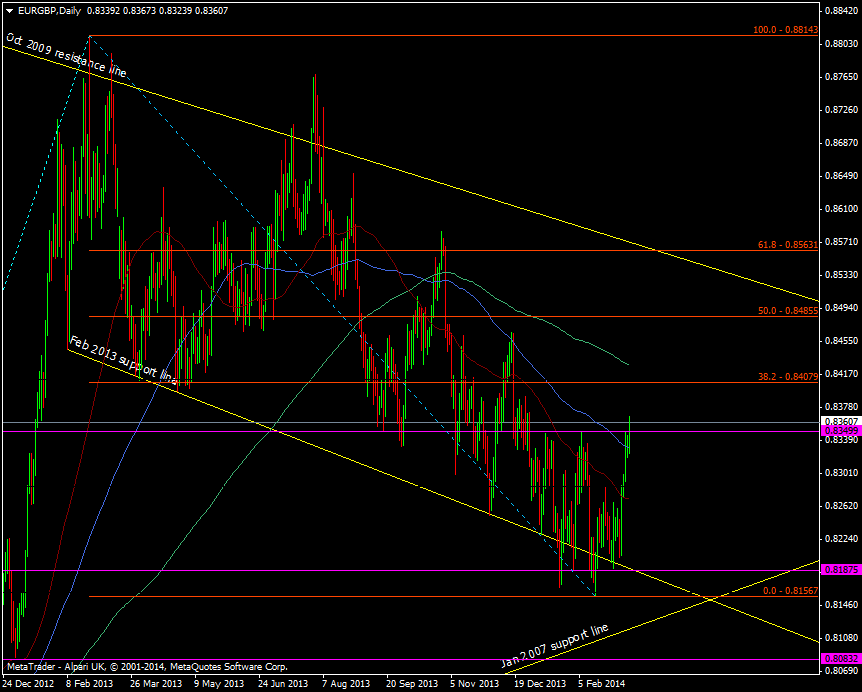

EUR/GBP is also a natural trade to look at. While the UK still has the upper hand in the recovery race a decent shift in Europe would likely trump the UK side of the trade and we could see the cross push the upper end of the current range in the first instance.

EUR/GBP daily chart 12 03 2014

There may still be room for a look to the downside and I now like the Feb 2013 support line, double bottom at 0.8155/65 and the 2007 support line even more as an area to start building longs from.

As we’ve seen today, when the euro planets align it’s a one way street so this analysis is likely to be applicable to to most pairs with a € symbol on it. Just under a year ago we got signs of a possible recovery and I wrote that the one pair to look at was EUR/CHF. As we’ve now seen the recovery never came and there was a further way down for it to go. The analysis back then stands now (I was just way ahead of the curve

Well, that’s the excuse I’m going with

). The race on rates is on, as I pointed out in an earlier post today on the ECB and SNB. If the recovery really kicks in and inflation picks up then the talk will turn (as it has in the UK) to rate rises not rate cuts and that will be the meal ticket for EUR/CHF.

At the end of the day one can go too in depth into analysis and I hope I haven’t done that here. For a simpler view just ask yourself these questions and answer honestly.

- Do you really see real deflation in Europe?

- Do you really see the European economy collapsing from here?

If you answer both of those with “no” then you know what the trade is from here.

Europe could be coming out of it’s coma.